There are lots of reasons to read economics blogs. Here’s one of them (something to do with Facebook, apparently; I couldn’t tell you what).

via Brad DeLong

jonathan lundell

There are lots of reasons to read economics blogs. Here’s one of them (something to do with Facebook, apparently; I couldn’t tell you what).

via Brad DeLong

John Mauldin quotes (famous pessimist) Nouriel Roubini:

A severe global recession will lead to deflationary pressures. Falling demand will lead to lower inflation as companies cut prices to reduce excess inventory. Slack in labour markets from rising unemployment will control labor costs and wage growth. Further slack in commodity markets as prices fall will lead to sharply lower inflation. Thus inflation in advanced economies will fall towards the 1 per cent level that leads to concerns about deflation.

Deflation is dangerous as it leads to a liquidity trap, a deflation trap and a debt deflation trap: nominal policy rates cannot fall below zero and thus monetary policy becomes ineffective. We are already in this liquidity trap since the Fed funds target rate is still 1 per cent but the effective one is close to zero as the Federal Reserve has flooded the financial system with liquidity; and by early 2009 the target Fed funds rate will formally hit 0 per cent. Also, in deflation the fall in prices means the real cost of capital is high – despite policy rates close to zero — leading to further falls in consumption and investment. This fall in demand and prices leads to a vicious circle: incomes and jobs are cut, leading to further falls in demand and prices (a deflation trap); and the real value of nominal debts rises (a debt deflation trap) making debtors’ problems more severe and leading to a rising risk of corporate and household defaults that will exacerbate credit losses of financial institutions.

— Professor Nouriel Roubini of New York University

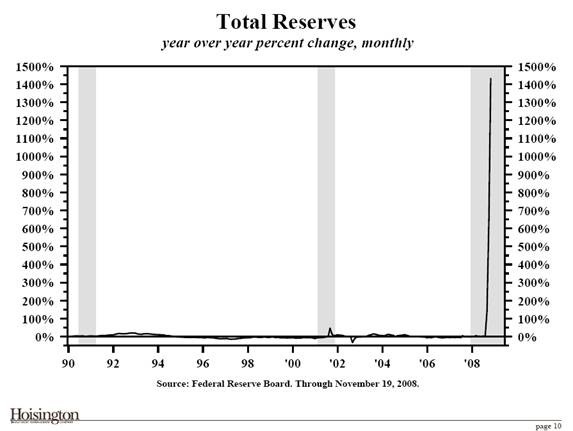

I keep seeing graphs that suggest that something exceptional is going on. Here’s one from Mauldin’s post:

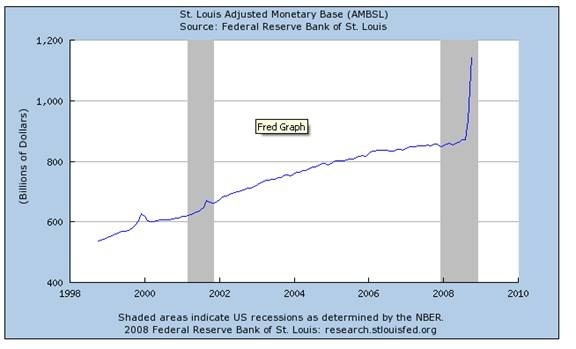

That’s percentage growth. Here’s the result:

I guess we can conclude that the Fed is working pretty hard to prevent deflation. But maybe not; it’s apparently more complicated, and even more complicated on top of that.

Figures. Go read Mauldin. (Any relation?)

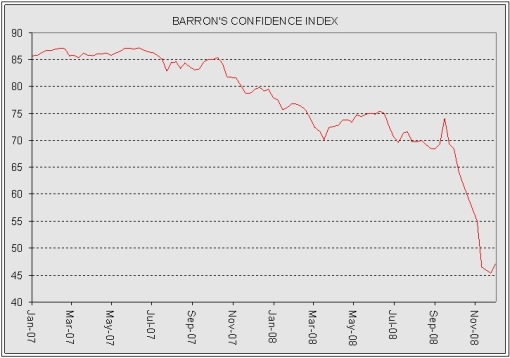

Lots of graphs today via Barry Ritholtz. Click the link for all of ’em, but here’s one. Is it bad news that the index is in the toilet? Good news that it’s ticked up?

Beats me.

Credit Crisis Watch (December 8, 2008)

Another indicator worth keeping an eye on is the Barron’s Confidence Index. This Index is calculated by dividing the average yield on high-grade bonds by the average yield on intermediate-grade bonds. The discrepancy between the yields is indicative of investor confidence. A declining ratio indicates that investors are demanding a higher premium in yield for increased risk. A slight improvement has taken place over the past week, but hardly of the magnitude to indicate restored confidence in the economy.

It seems to be a morning for exceptional posts. Not mine, but I can point to ’em. (I did miss Krugman’s Nobel lecture, 3am here on the left coast. Have to catch the video, I guess.)

George W. Bush – An Appreciation

… But who, in fact, was he? And I think the plain answer is that he was no one special, one more failed scion of a failing family, a ruler who could only be considered remarkable, whether for better or worse, in a nation that still fancies itself a democracy. Were we communists, or better yet a monarchy, his vapidity and mediocrity wouldn’t shock us at all. People less in thrall to the myth of their own great, national, deliberative process are less inclined to surprise when a bumbler, an asshole, or a moron shows up in the imperial palace, playing dress-up and treating international affairs like a board game. Your own experience in a hierarchy without democratic pretensions should tell you as much. It might drive you nuts, but when was the last time you were surprised that the boss turned out to be an idiot? One could make the case, perhaps, that elections are a reasonable scheme for a city-state somewhere, but a hundred million harried citizens making hazy decisions after two years of propaganda isn’t qualitatively different from the happenstance of heredity or the rolling of dice. And George W. Bush, god bless him, is the proof.

Barry Ritholtz has such a brilliantly obvious idea for solving all our public funding problems that in good conscience I can’t do anything but post it in its entirety.

How to Pay for National Health Insurance

Since the government has spent such an inordinate amount of taxpayer money cleaning up after the Wall Street ne’er-do-wells and the giant mess they made, there is not a whole lot of money left over for other projects.

Once such legislative work was National Health Insurance. Surveys have shown that a significant majority of Americans support this. It was one of the key planks that President-elect Barack Obama ran on.

Well, no worries over the lack of funding for health care. I have figured out a simple way to insure that every man woman and child int he US is covered by health care insurance. I took a page from the cleverest of the financial engineers on Wall Street, and all it took was a little of that street magic and derivative-based hocus pocus.

It goes something like this:

- Set up a large, well capitalized hedge fund. About $5B should do it.

- The prospectus of the fund should note its purpose is to “Seek out profit opportunities via arbitraging inefficiencies in the markets and health care system of the United States.” Include standard “Socially Conscious” fund language in clauses such as Do well by doing good.

- Launch the fund — and promptly max out your leverage. Today’s environment makes it difficult to go 50 to 1, but getting 10 or 20 to 1 should not be much problem.

- Use the money to write Credit Default Swaps with a notational value of $3 trillion dollars. The premia on these CDS should be about 10-15% or so.

- Rollover the cash premiums — about $350 billion dollars worth — into a national fund. Use it to buy health care insurance for all US citizens.

- Declare that due to current credit conditions, your unfortunately must announce to your counter-parties that you will be defaulting on these CDS. Note that significant amounts of this paper are held by JP Morgan and Citi. Another trillion is held by China and Japan, with Sovereign Wealth Funds owning the rest.

- Send out a press release announcing “systemic risk.” Tell the Treasury Secretary and the Federal Reserve Chief that your imminent collapse will wreak global havoc. Apply for bailout.

Congratulations! You have National Health Care!

Repeat for any major government program: Alternative energy, School Vouchers, Mars Mission, Global warming, Missile Defense Shild, etc.

Note: This is how all government spending programs will be funded in the future.

James Ridgeway.

AARiP-Off: Group Rakes in Funds from Medicare Prescription Drug Plans

…

As the main lobby representing the 37 million Americans over 65 (12 percent of the population), AARP ought to be leading the charge against a program that puts corporate profits before its members’ health. Instead, its efforts have focused on reaping a large share of those profits itself.

…

Now, Bloomberg news has reported that AARP “collects hundreds of millions of dollars annually from insurers who pay for AARP’s endorsement of their policies…The insurance companies build the cost of these so-called royalties and fees, which amounted to $497.6 million in 2007, into the premiums they charge AARP members, according to AARP’s consolidated financial statement for that year.” Critics say that the AARP-sponsored policies often sell at inflated prices, and don’t offer the best coverage for the money.

…

A study released last week by the Center for Economic and Policy Research found that three years into the program, “most seniors experienced no reductions in their health care spending as a result of the Medicare Drug benefit.”

Is it premature to be this cynical?

Nah…

Joseph Stiglitz: Keynesian economics finds new relevancy in the 21st century global economy

… Today, the risk is that the new Keynesian doctrines will be used and abused to serve some of the same interests. Have those who pushed deregulation 10 years ago learned their lesson? Or will they simply push for cosmetic reforms — the minimum required to justify the mega-trillion dollar bail-outs? Has there been a change of heart, or only a change in strategy? After all, in today’s context, the pursuit of Keynesian policies looks even more profitable than the pursuit of market fundamentalism! …

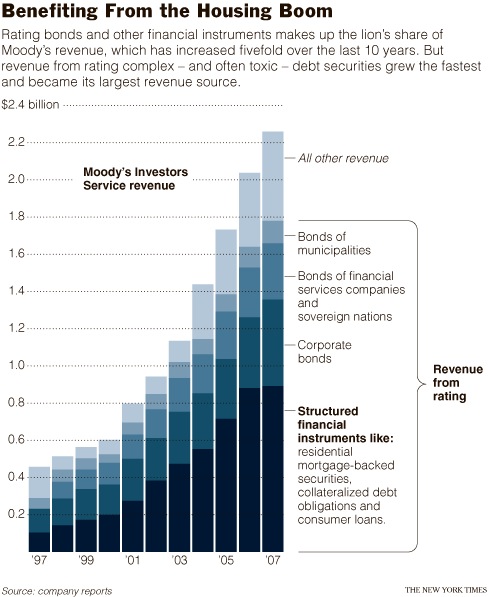

“We obviously cannot ask payment for rating a bond. To do so would attach a price to the process, and we could not escape the charge, which would undoubtedly come, that our ratings are for sale.”

— Edmund Vogelius, a Moody’s vice president, explained the company’s business model in a 1957 article in The Christian Science Monitor

via Barry Ritholtz; graphic via NY TImes

A lot.

I reflected on the 15 or so Canon bodies that I’ve purchased since 1994. All performed flawlessly from the time that they were removed from the box until they were given away. All of the people to whom I’ve given Canon bodies are still using them with no problems. These are machines with motors, springs, electronics, etc. that are subject to vibration, impact, dust, water, and the other hazards of modern life.

Let’s be honest with ourselves and ask if there is an American company that could produce anything competitive to the Canon 5D. Keep in mind that Canon makes the CMOS sensor in its own fab. Canon writes the software itself. Canon designs and makes the lenses. An American company is lucky if it can handle a challenge in one domain; everything else needs to be contracted out.

What about Japan? How deep is their technological prowess? If they didn’t have Canon they’d have to supply us with cameras from Nikon, Olympus, Pentax, and Sony.

via Jorn Barger

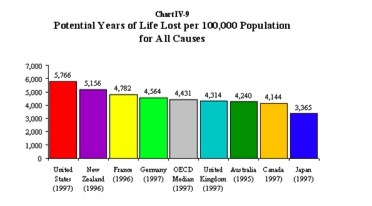

Noah Pollak begins well: “I am far from knowledgeable about health care…”, but really should have stopped there. The rest of the post is roughly the usual “We’re #1 and don’t give me all those stats about the godless commies in Europe”. The loony conclusion:

But this controversy really isn’t about health care. It’s about the need for people who support the dramatic expansion of government to minimize, obfuscate, or render illusory the trade-offs inherent in such expansion.

Sheesh.

Ezra Klein is on the case.

Here’s an earlier post on the subject of the prostate cancer stats that Pollak trots out.

Who Would’ve Thought, It Figures

Last month, the New York Stock Exchange suspended trading on BearingPoint because its stock price had fallen too low. Yesterday the price was 3.45 cents a share. Alejandro Lazo writes in today’s Washington Post:

Jamie Friedman, an analyst with Susquehanna Financial who dropped coverage of the company in recent weeks, said that while the company’s government contracting business has held up in recent years, its commercial side has suffered from competition overseas and managerial missteps.

Now … this is kind of interesting. It’s like, oh, rain on your wedding day, or ten thousand spoons when all you need is a knife. BearingPoint, of course, was hired by the Bushies to structure rules for a free market economy in Afghanistan and Iraq, as part of an All-American pre-fab Galt’s Gulch program flown in on a C-130 for the eagerly awaiting locals with all those flowers in their hands.

…and doesn’t like what he sees.

Training the Afghan army is a worthy goal, but in the meantime the country is increasingly in the hands of a fractious band of Taliban, allied with myriad leaders who think nothing of battling one another. There is no sign that the Taliban are weakening: they have an apparently endless supply of men and arms and they don’t mind losing large numbers of men, because even casualties can be spun into propaganda that suggests they have plenty of followers to spare. They do not have the power they did in the 1990s, when they swept across Afghanistan with little resistance, or the popular support they enjoyed while fighting the Russians. Although the Taliban will never be able to defeat the US-led coalition, that same coalition will not be able to uproot the Taliban from rural Afghanistan, wipe out their bases of support and recruitment in Pakistan, or cut them off from the Afghan population.

The former Taliban government official – who served as a mujahideen commander until 1992 – reminded me that the Soviet army was larger and more powerful than the coalition today, with more than 100,000 troops, and that the Afghan government they supported was stronger than the current one as well.

“The end will be like with the Russians,” he said. “The Americans will never succeed in containing the conflict. There will be more bleeding, the evacuation of foreigners. It’s coming to the same situation – by 1985 or 1986, the Communist forces held only the provincial capitals. There were 465,000 military and civilian members of the puppet government. But the Russians were still confined to their bases.”

James Surowiecki says uncharacteristically little in this NYer piece: Wall Street seems to like T-Sec-designate Timothy Geithner, and said Geithner is a not-so-bad choice.

Pretty clearly, the article was an excuse to use a great title, a Shakespearean stage direction paraphrased from The Winter’s Tale.

Antigonus

… Weep I cannot,

But my heart bleeds; and most accursed am I

To be by oath enjoin’d to this. Farewell!

The day frowns more and more: thou’rt like to have

A lullaby too rough: I never saw

The heavens so dim by day. A savage clamour!

Well may I get aboard! This is the chase:

I am gone for ever.Exit, pursued by a bear

Alas, poor Antigonus: pursued, caught and consumed.

Clown

Go you the next way with your findings. I’ll go see

if the bear be gone from the gentleman and how much

he hath eaten: they are never curst but when they

are hungry: if there be any of him left, I’ll bury

it.

Will the bear eat Mr Geithner? Stay tuned.

Jamie Galbraith says no.

No. The question is grossly misconceived. Right now and for the immediate future, the budget deficit is the only source of demand that can fuel a recovery. Our present problem is not that it is too big, but that it is too small. Far too small.

So listen. (I’ve added a few links.)

We Ain’t Got the Money for the Mortgage on the Cow

One reason I’m a conservative is the British National Health Service. Until you have lived under socialism, it sounds like a great idea. It isn’t misery – although watching my parents go through the system lately has been nerve-wracking – but there is a basic assumption. The government collective decides everything. You, the individual patient, and you, the individual doctor, are the least of their concerns. I prefer freedom and the market to rationalism and the collective. That’s why I live here.

Oh-ho, rationalism and the collective. This is the sort of eruction that only exits a moron with no idea how health coverage works in the United States of America, and no interest in learning. “The government collective.” Jesus Christ, dude, I read We The Living before I got my pubes. Health plans don’t compete. There’s no free fucking market. Shit, BCBS licensees run Medicare for a lot of states. They run half the FEHBP. For all intents and purposes, the BCBSA is an arm of the Department of Health and Human Services. “You, the individual patient, and you, the individual doctor.” Hardeehar. Ken Melani eats a cardiopulmonary specialist for breakfast every day and washes it down with a pint of blood from a nearby ENT. Individual patients. It’s insurance, man. It’s actuarial. It’s lies, damned lies, and statistics.

I mean, do people seriously entertain the idea that health insurers do not ration coverage, that PPOs and HMOs operate with less bureaucratic opacity than government agencies, that administrative decisions aren’t made without the consent (or knowledge) of patients all the time? Does Andrew Sullivan really see a vibrant and competitive market driving down the cost of health coverage while increasing the availability and diversity of product? Or is he just spouting doctrinaire fag-Tory cant of which veracity he has no idea because, after all, don’t bite the hand that feeds ya.

Below is NPR’s Scott Simon’s commentary from last Saturday morning (you can listen to it by following the link).

Setting aside the implication that we shouldn’t bother with terrorist motivations (that’s just silly; how, for instance, could Irish terrorism have been stopped without consideration of the motivations of both sides?), and setting aside the London Blitz, Dresden, Hiroshima, Nagasaki, the Bible seems to me to be a very peculiar standard to introduce in this context, except perhaps as a cautionary example.

Two examples will suffice. The first is the hero and judge Samson (think Delilah—that Samson). Samson had an extensive career in terror, but let’s just recall his last act. He’s been captured (cherche la femme) by the Philistines, and eventually brought out to a temple full of civilians, “three thousand men and women”, says the Good Book.

And Samson said, Let me die with the Philistines. And he bowed himself with all his might; and the house fell upon the lords, and upon all the people that were therein. So the dead which he slew at his death were more than they which he slew in his life.

Why? Revenge, we suppose, but let’s not inquire into his motives.

Now set the clock back a bit. Israel has just been delivered from Egypt, Moses is dead, and Joshua is the new leader. They’ve traveled to Canaan, and the city of Jericho, where they spend several days marching around its walls. Finally,

…the people shouted with a great shout, that the wall fell down flat, so that the people went up into the city, every man straight before him, and they took the city.

And they utterly destroyed all that was in the city, both man and woman, young and old, and ox, and sheep, and ass, with the edge of the sword.

“But there are times and crimes,” Simon says, “that remind me how often the Bible gets it right.”

I get increasingly uncomfortable with the convention of journalism that requires us to say that so far, we don’t know the motives of the people who carried out this week’s attacks in Mumbai.

A word like “motive” seems to imply there was reason or purpose. It suggests that, however profane their actions, the terrorists had the incentive of some goal in mind.

But after covering too many killings, as a reporter or host, in Bosnia, Kosovo, Oklahoma City or Somalia, I’ve come to the conclusion that the perpetrators of such crimes might just be … evil.

Evil is a word that many people of my generation shrink from using. It seems so imprecise and uneducated — biblical, rather than cerebral and informed.

But there are times and crimes that remind me how often the Bible gets it right.

At some point, someone might record a statement, credited to some group, claiming responsibility for the killings in Mumbai, and send it out to the world. At some point, someone might write some kind of screed, display his education by calling it a manifesto that gets quoted by the best news organizations, including our own.

Terrorists may rationalize their actions with political rhetoric. They may band together, train together, and, ultimately, die together, and thereby give each other the strength and reassurance to believe that they are not alone. Other people share their convictions and help shoulder their actions. So how can they be crazy, much less evil?

But Romeo Dallaire, the courageous Canadian general who tried to stop massacres in Rwanda, once told us that evil men and women see no innocents in the world. They will slaughter mothers without conscience and their children, too, because mothers give birth to children who can grow up to be their opponents.

Evil people are not dumb, he said. They simply use the power of their mind to cut off their conscience.

The people killed this week in Mumbai were not collateral damage, which has become an ugly enough term, but the very objects of damage: human beings who became the targets of a murder spree, however terrorists and apologists may ultimately embroider the assault with supposed political significance. Americans, Britons, Israelis, Indians and Jews seemed to be the particular targets. But those who died were from all over the world and at all stages of life: married couples, religious pilgrims, old people and young people, a father and his young daughter who were learning about meditation.

As investigations and analysis continue over the next few weeks, it may be good to refresh ourselves with the memory of their worthy lives.

Here’s a nifty graphic from the USGS. This version is a little small; click it to see a bigger one at the USGS site, where you can also download even bigger copies.

The Earth is very old — 4.5 billion years or more according to recent estimates. Most of the evidence for an ancient Earth is contained in the rocks that form the Earth’s crust. The rock layers themselves — like pages in a long and complicated history — record the surface-shaping events of the past, and buried within them are traces of life — the plants and animals that evolved from organic structures that existed perhaps 3 billion years ago.

Also contained in rocks once molten are radioactive elements whose isotopes provide Earth with an atomic clock. Within these rocks, “parent” isotopes decay at a predictable rate to form “daughter” isotopes. By determining the relative amounts of parent and daughter isotopes, the age of these rocks can be calculated.

Thus, the results of studies of rock layers (stratigraphy), and of fossils (paleontology), coupled with the ages of certain rocks as measured by atomic clocks (geochronology), attest to a very old Earth!

John Scalzi explains it all for you.

Been asked a couple times now if I had any thoughts about what’s going on with the political situation up north there in Canada, and I have to say: Honestly, I don’t know what the hell’s going on up there. They had an election, and the Prime Minister said “nyah,” and then the other political parties said, “Oh, no you DIN’T” and then exploding space monkeys swarmed Ottawa and the Queen had to fly over to beat people and monkeys with her scepter and at the end of it all Quebec was put on the block? And traded for a fish? Or something? It’s all really confusing to us simple folks down here in the US, with our uncomplicated election process that never goes wrong, ever. All I know is at the end of it, Canada will still have national health care and we won’t. So there’s that.

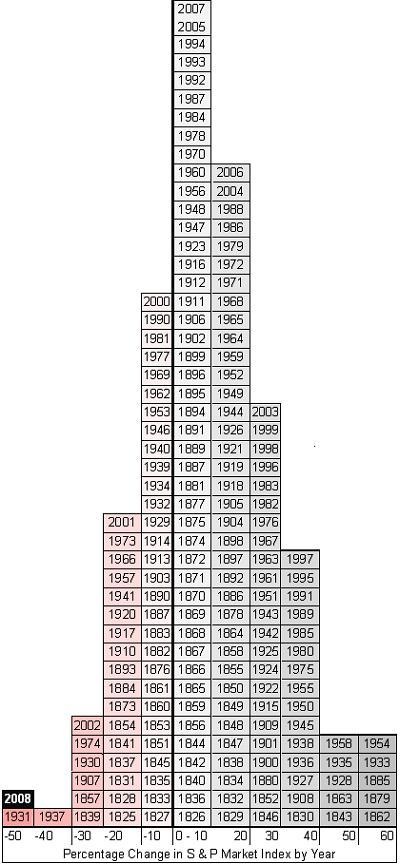

Via Devilstower, the change in the S&P 500 by year, sorted into buckets. If you’re looking for 1929 (I was), it’s in the –10% column.

Royal Shakespeare Company to stop using ‘distracting’ real skull in Hamlet

The use of the skull had been kept a carefully guarded secret throughout the play’s four month run in Stratford until leading man David Tennant disclosed that the skull belonged to the late pianist Andre Tchaikovsky — who bequeathed his skull to the RSC for this very purpose.

Andre Tchaikovsky left his skull to the RSC in 1982 after he died of cancer to be used on stage in Hamlet. It took a quarter of a century to happen — and he posthumously appeared as Yorick in the recent production of Hamlet at Stratford.

…

“He hated the way it was done. When he saw it with the RSC, he (Andre) said ‘I am going to leave my skull to the RSC, they really should have a proper skull. It doesn’t work with the plastic thing they have’. And then we looked at his will, and there it was.”