John Mauldin quotes (famous pessimist) Nouriel Roubini:

A severe global recession will lead to deflationary pressures. Falling demand will lead to lower inflation as companies cut prices to reduce excess inventory. Slack in labour markets from rising unemployment will control labor costs and wage growth. Further slack in commodity markets as prices fall will lead to sharply lower inflation. Thus inflation in advanced economies will fall towards the 1 per cent level that leads to concerns about deflation.

Deflation is dangerous as it leads to a liquidity trap, a deflation trap and a debt deflation trap: nominal policy rates cannot fall below zero and thus monetary policy becomes ineffective. We are already in this liquidity trap since the Fed funds target rate is still 1 per cent but the effective one is close to zero as the Federal Reserve has flooded the financial system with liquidity; and by early 2009 the target Fed funds rate will formally hit 0 per cent. Also, in deflation the fall in prices means the real cost of capital is high – despite policy rates close to zero — leading to further falls in consumption and investment. This fall in demand and prices leads to a vicious circle: incomes and jobs are cut, leading to further falls in demand and prices (a deflation trap); and the real value of nominal debts rises (a debt deflation trap) making debtors’ problems more severe and leading to a rising risk of corporate and household defaults that will exacerbate credit losses of financial institutions.

— Professor Nouriel Roubini of New York University

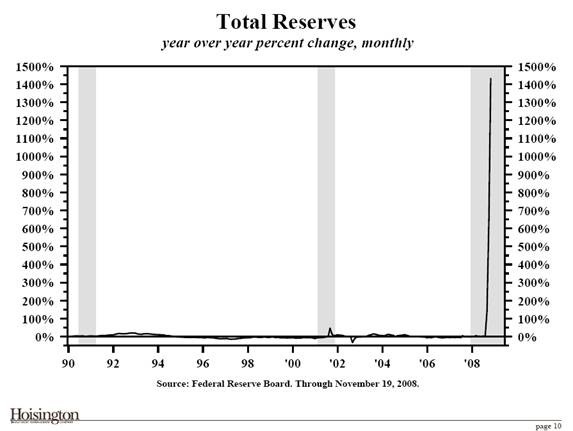

I keep seeing graphs that suggest that something exceptional is going on. Here’s one from Mauldin’s post:

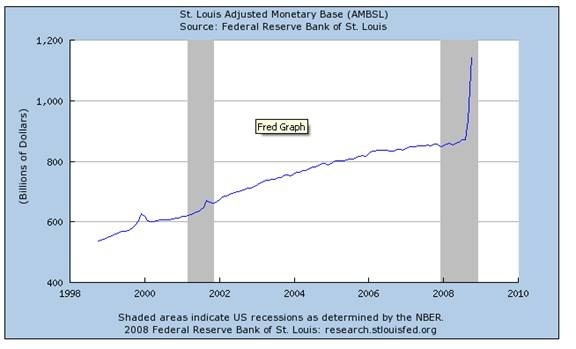

That’s percentage growth. Here’s the result:

I guess we can conclude that the Fed is working pretty hard to prevent deflation. But maybe not; it’s apparently more complicated, and even more complicated on top of that.

Figures. Go read Mauldin. (Any relation?)