Ryan Avent.

The Worst Option, Except for All the Others

…

The issue is this — banks have assets that are worth much less than they’re currently being valued on the books. If banks fix this problem, they are suddenly and obviously insolvent. If they don’t, then they linger on in zombie mode, dragging down the broader economy, for years. The government therefore has to get rid of some of these assets. If it pays book value, then the taxpayers basically hand an extraordinary amount of money over to the banks. If it pays market value, the banks are insolvent. If the government pays something in the middle, then the taxpayers take a bath, and the banks are probably still insolvent.

A very bad solution to this crisis is nationalization. It’s bad because there are risks that the government will run the banks poorly, or make questionable loans, or that nationalization will be contagious — fear of nationalization will cause investors to abandon healthy banks, forcing the government to nationalize the entire banking sector instead of just the rotten firms. But as bad as nationalization is, it’s better than the other available solutions. No one wants to take this step, but given that taxpayers are going to be spending tons of money and taking on piles of risk to fix the banking sector, it makes sense that whatever value is left in the firms be confiscated to offset the costs (with the understanding that they’ll be re-privatized as soon as conditions allow).

Absent a definitive solution to this problem, banks will linger on in zombie mode, afraid or unable to facilitate economic activity appropriately. A definitive solution sans nationalization means an extremely expensive, and in all likelihood politically impossible, transfer of government money to the banks. It’s time to get over our fear of the word nationalization and do what’s best for the economy and for taxpayers.

Consider, for example, the extant worse-yet option, TARP. This is Michael R. Crittenden, Dow Jones Newswires, via CNN:

… “Our money — and our economy — are on the line, and we all have a stake in the outcome,” said Harvard Law School professor Elizabeth Warren in her prepared remarks for a Senate Banking Committee hearing.

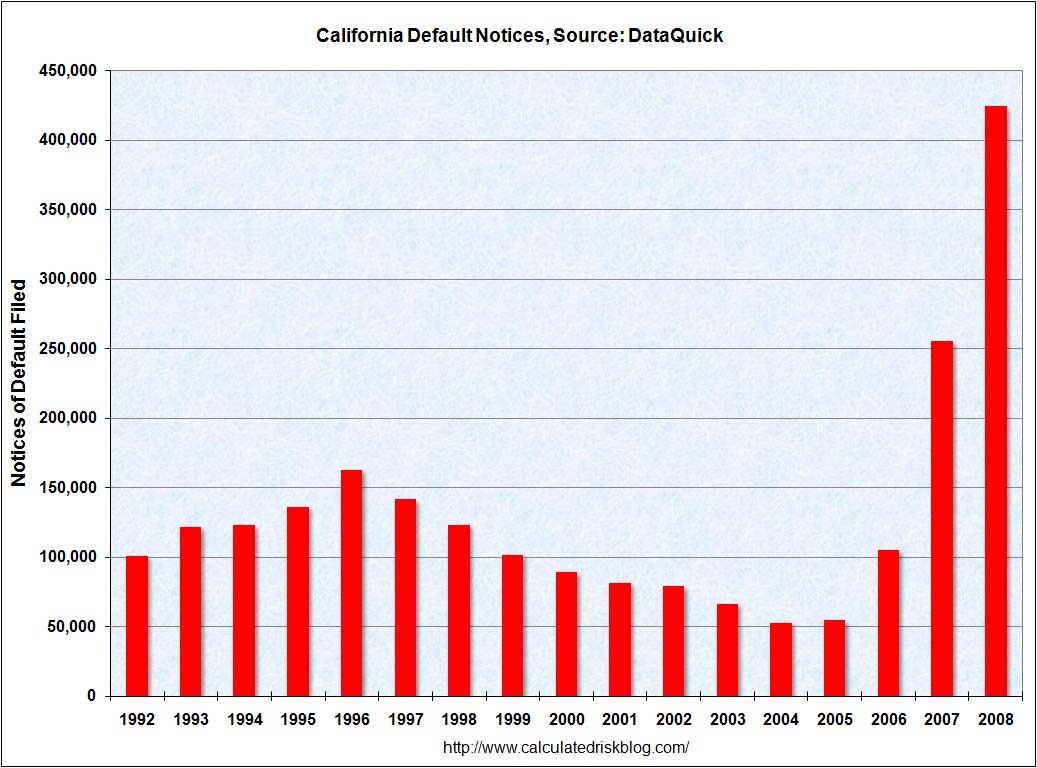

Warren heads the five-member congressional oversight panel overseeing the TARP, and said that the group on Friday will issue a report suggesting Treasury has significantly overpaid for the assets it has purchased from financial institutions. She said an analysis of 10 of the TARP transactions, when extrapolated for all of the purchases made in 2008, suggests Treasury paid $254 billion for assets worth approximately $176 billion, a shortfall of $78 billion.

“Treasury paid substantially more for the assets it purchased under the TARP than their then-current market value,” Warren said. …

One more bit of Avent’s piece:

The plan, now, is to guarantee some assets and buy others at a price between book value (what the banks say an asset is worth) and actual value, using money from the second half of the TARP allotment, that is, something less than $350 billion. Which basically means that the adminstration seems content to perpetuate the old policy of doing something inadequate because something has to be done.

Today is, of course, the fiftieth anniversary of Buddy Holly’s death in a plane crash in Iowa. A lot of rockers have died too young, but it’s hard to believe that any of those deaths represented a greater loss to music than Holly’s.

Today is, of course, the fiftieth anniversary of Buddy Holly’s death in a plane crash in Iowa. A lot of rockers have died too young, but it’s hard to believe that any of those deaths represented a greater loss to music than Holly’s.

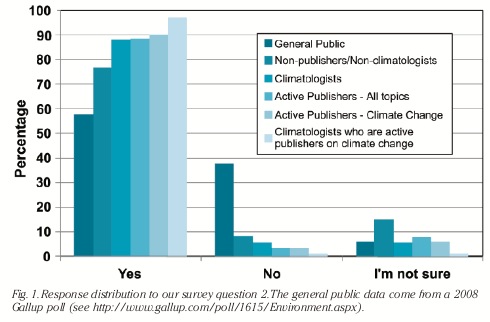

According to a 2007 Newsweek poll, 42% of Americans believe that “there is a lot of disagreement among climate scientists about whether human activities are a major cause” of global warming”. I posed the same question to members of the wunderground community on Monday, and even higher 56% of them thought so. However, the results of a poll that appears in this week’s edition of the journal EOS, Transactions, American Geophysical Union, reveals that the public is misinformed on this issue. Fully 97% of the climate scientists who regularly publish on climate change agreed with the statement, “human activity is a significant contributing factor in changing mean global temperatures”. …

According to a 2007 Newsweek poll, 42% of Americans believe that “there is a lot of disagreement among climate scientists about whether human activities are a major cause” of global warming”. I posed the same question to members of the wunderground community on Monday, and even higher 56% of them thought so. However, the results of a poll that appears in this week’s edition of the journal EOS, Transactions, American Geophysical Union, reveals that the public is misinformed on this issue. Fully 97% of the climate scientists who regularly publish on climate change agreed with the statement, “human activity is a significant contributing factor in changing mean global temperatures”. …