Here’s a nice graph, courtesy of Brad DeLong, of household incomes going back 40 years or so. These are inflation adjusted (for some definition of inflation). Click for a bigger version.

Author: Jonathan

You have no idea

I have a small collection of pending posts that make this point: many, maybe most, Americans with health insurance have no idea how shaky their coverage will be when they really need it. This one is from Andrew Koppelman.

… In a characteristically smart posting at the New Republic website, William Galston observes that a major obstacle to President Obama’s aspirations for health care reform is that most Americans are satisfied with the insurance they have:

Seventy-three percent describe the affordability of basic medical care for themselves and their families as “manageable” or even “easy”; 69 percent say that their health insurance company pays for all or most of the treatments and medicines they current need; and fully 76 percent say they are very or somewhat confident that if they were to become seriously injured or ill, their insurance would pay for everything they needed to get better. According to the Kaiser Family Foundation, the share of Americans who believe that they or their families would be worse off under reform has risen by 20 percentage points since February. Today, fully 51 percent are more worried about the health reform bill they expect Congress to pass than by the possibility that reform will be delayed beyond this year.

This data sits uneasily beside a recent study in the American Journal of Medicine of personal bankruptcies in the United States.In 2007, 62% of all personal bankruptcies were driven by medical costs.”Nationally, a quarter of firms cancel coverage immediately when an employee suffers a disabling illness; another quarter do so within a year,” the report states.Most of the medical debtors were well educated, owned homes, and had middle-class occupations, and three-quarters of them had health insurance. “Unless you’re a Warren Buffett or Bill Gates, you’re one illness away from financial ruin in this country,” lead author Steffie Woolhandler, M.D., of the Harvard Medical School, said in an interview. “If an illness is long enough and expensive enough, private insurance offers very little protection against medical bankruptcy, and that’s the major finding in our study.” …

It’s time to embrace American royalty

I’ve had this bit from Glenn Greenwald hanging around for the last week or so. I really need to add Glenn to my blogroll.

It’s time to embrace American royalty

We’re obviously hungry to live with royal and aristocratic families so we should really just go ahead and formally declare it:

Bush daughter Jenna Hager becomes ‘Today’ reporter NBC’s “Today” show has hired someone with White House experience as a new correspondent — former first daughter Jenna Hager, the daughter of former President George W. Bush. . . . She “just sort of popped to us as a natural presence, comfortable” on the air, [Executive Producer Jim] Bell said. Hager will work out of NBC’s Washington bureau.

They should convene a panel for the next Meet the Press with Jenna Bush Hager, Luke Russert, Liz Cheney, Megan McCain and Jonah Goldberg, and they should have Chris Wallace moderate it. They can all bash affirmative action and talk about how vitally important it is that the U.S. remain a Great Meritocracy because it’s really unfair for anything other than merit to determine position and employment.

…

Anonymization … isn’t.

Ars Technica: “Anonymized” data really isn’t—and here’s why not

The Massachusetts Group Insurance Commission had a bright idea back in the mid-1990s—it decided to release “anonymized” data on state employees that showed every single hospital visit. The goal was to help researchers, and the state spent time removing all obvious identifiers such as name, address, and Social Security number. But a graduate student in computer science saw a chance to make a point about the limits of anonymization.

Latanya Sweeney requested a copy of the data and went to work on her “reidentification” quest. It didn’t prove difficult. Law professor Paul Ohm describes Sweeney’s work:

At the time GIC released the data, William Weld, then Governor of Massachusetts, assured the public that GIC had protected patient privacy by deleting identifiers. In response, then-graduate student Sweeney started hunting for the Governor’s hospital records in the GIC data. She knew that Governor Weld resided in Cambridge, Massachusetts, a city of 54,000 residents and seven ZIP codes. For twenty dollars, she purchased the complete voter rolls from the city of Cambridge, a database containing, among other things, the name, address, ZIP code, birth date, and sex of every voter. By combining this data with the GIC records, Sweeney found Governor Weld with ease. Only six people in Cambridge shared his birth date, only three of them men, and of them, only he lived in his ZIP code. In a theatrical flourish, Dr. Sweeney sent the Governor’s health records (which included diagnoses and prescriptions) to his office.

Boom! But it was only an early mile marker in Sweeney’s career; in 2000, she showed that 87 percent of all Americans could be uniquely identified using only three bits of information: ZIP code, birthdate, and sex.

Such work by computer scientists over the last fifteen years has shown a serious flaw in the basic idea behind “personal information”: almost all information can be “personal” when combined with enough other relevant bits of data.

…

Why aren’t children taught to touch-type at school?

Gordon Rayner in The Telegraph (strike-out mine):

For more than a century, the cornerstones of education have been reading, writing and arithmetic, but surely every

Britishchild would benefit if we added a fourth core skill to that list: touch-typing.All children are given endless hours of coaching in how to use the most common computer applications, such as Windows, spreadsheets and PowerPoint, all of which are likely to have moved on significantly by the time current primary school pupils enter the world of work.

Yet they are taught how to use these programs without being taught the most basic computing skill of all – typing. It is the modern-day equivalent of teaching a child to do joined-up writing without ever showing them how to hold a pencil. …

Looking (way, way) back on my high-school career, I see now that the single most useful class I took, measured in day-to-day utility these decades later, was a half-semester of typing. I took the course because I ran out of other classes in my rural high school (there were 16 in my class that junior year) in an era in which there were typewriters, not computers, on the world’s desktops.

Nixon’s Plan For Health Reform, In His Own Words

Kaiser Health News has posted Nixon’s 1974 plan for universal health care. What a commie.

Comprehensive health insurance is an idea whose time has come in America.

There has long been a need to assure every American financial access to high quality health care. As medical costs go up, that need grows more pressing.

Now, for the first time, we have not just the need but the will to get this job done. There is widespread support in the Congress and in the Nation for some form of comprehensive health insurance.

Surely if we have the will, 1974 should also be the year that we find the way.

Aging in Japan revisited

KQED’s Forum had a semi-interesting hour yesterday called Election in Japan. Their description:

After 50-plus years of nearly unbroken rule, Japan’s conservative Liberal Democratic Party met defeat by the more liberal Democratic Party in the recent election. With record joblessness and an aging population, what challenges and opportunities might the new Japanese government face?

Host: Michael Krasny

Guests:

- Daniel Okimoto, chairman of the Sterling Stamos Global Institute and director emeritus of the Shorenstein Asia-Pacific Research Center

- Michael Zielenziger, journalist, visiting scholar at UC Berkeley’s Institute of International Studies and author of “Shutting Out the Sun: How Japan Created Its Own Lost Generation”

- Sheila Smith, senior fellow for Japan studies at the Council on Foreign Relations

However, you’ll no doubt have noticed the red-flag phrase “record joblessness and an aging population” in the program’s description. Conveniently, Dean Baker (who else?) knocked down similar nonsense a day earlier. It’s a pity that Krasny and his guests didn’t read it, or any of the many other posts Baker has done on the general subject.

Is Japan Suffering from an Aging Population?

This is very fashionable to say in all the news coverage on Japan (a “worrying rise of the world’s oldest population,” A), but it’s not clear what it means. The concern is that Japan will not have a large enough workforce to support its dependent elderly population. There is no evidence of that problem at present, when the unemployment is a historically high (for Japan) unemployment rate of 5.7 percent.

As a more general issue, a relative decline in the size of the labor force would simply mean that the least productive jobs go unfilled. This could mean, for example, that jobs held by the pushers who shove people into Tokyo’s overcrowded subways may go unfilled. There may be fewer people working as parking lot attendants, custodians in office buildings and convenience store clerks. As an offset, this densely populated country, with very high land prices, will become less densely populated and have lower land prices. It will also be much easier for Japan to reduce its greenhouse gas emissions and other pollutants. It is difficult to see where the crisis lies.

Of course one reason that Japan has such an old population is that its life expectancy is so long. At 82.1 years its life expectancy at birth is four years longer than that of the United States. It is also worth noting that, despite a debt to GDP ratio of more than 180 percent, its annual interest burden is less than that of the United States.

—Dean Baker

The difference between a democratic society and a consumer society

In my last post I quoted Robert Hass’s Twentieth Century Pleasures: Prose on Poetry, but no Hass. So here’s a bit of Hass himself. I love this paragraph, especially the last sentence, which I’m still puzzling over.

Now, I think, free verse has lost its edge, become neutral, the given instrument. An analogy occurs to me. Maybe it is a little farfetched. I’m thinking of balloon frame construction in housing. According Gideon, it was invented by a man named George Washington Snow in the 1850s and 1860s, about the same time as Leaves of Grass. “In America materials were plentiful and skilled labor scarce; in Europe skilled labor was plentiful and materials scarce. It is this difference which accounts for the differences in the structure of American and European industry from the fifties onn.” The principle of the balloon frame was simply to replace the ancient method of mortise and tenon—heavy framing timbers carved at the joints so that they locked heavily together—with construction of a frame by using thin studs and nails. it made possible a light, quick, elegant construction with great formal variability and suppleness. For better or worse. “If it had not been for the balloon frame, Chicago and San Francisco could never have arisen, as they did, from little villages to great cities in a single year.” The balloon frame, the clapboard house and the Windsor chair, American forms, and Leaves of Grass which abandoned the mortise and tenon of meter and rhyme. Suburban tracts and the proliferation of poetry magazines. The difference between a democratic society and a consumer society.

Sampling Herrick

I’ve been reading Robert Hass’s Twentieth Century Pleasures: Prose on Poetry. I’m mostly out of my depth, but it’s rewarding nonetheless.

Hass gives us a poem from Nils Petersen. Let me remind you of the Herrick first, a fine, sly piece of work.

Whenas in silks my Julia goes

Then, then (methinks) how sweetly flows

That liquefaction of her clothes.Next, when I cast mine eyes and see

That brave vibration each way free;

O how that glittering taketh me!

Here’s Petersen.

Whenas in silks

Whenas in silks

My Julia goes

My Julia goes

Then, then methinks (methinks)

How sweetly flows

Sweetly flows

The liquefaction (faction) (faction)

Of her clothes

her clothes her clothes

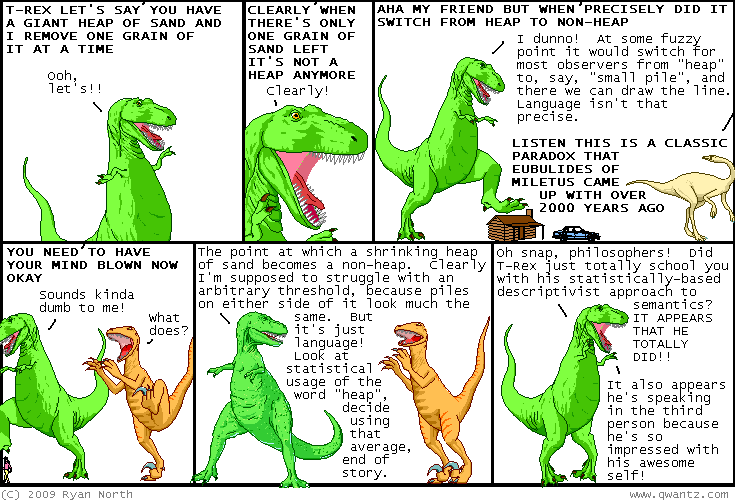

Sorites in the comics

Dinosaur Comics are my favorite comics. Today, anyway. If you’re not familiar with the DC conventions, go browse a few dozen; you won’t regret it.

Tomorrow my favorite may be Red Meat; it was, back on October 27, 1977, and it could be again. Don’t say I didn’t warn you.

(If you want to see the reference from the missing panel 7 mentioned in the tooltip, it’s here.)

via Mark Liberman

Non-random coin flipping

Bruce Schneier points to a paper on the statistics of coin-tossing. Summary of the summary: not random. One item:

If the coin is tossed and caught, it has about a 51% chance of landing on the same face it was launched. (If it starts out as heads, there’s a 51% chance it will end as heads).

In retrospect, this is not all that surprising. It’s good to keep in mind.

Commenter Michael Ash suggests a mechanism for compensating for the bias:

Flip the coin twice. If the first one is heads and the second tails, take one choice. If the first is tails and the second heads, take the other choice. If you get the same face both times, start over. This last part is key: you must start over and flip two more times, and keep flipping in pairs until you get two different faces. It’s not enough to just flip in sequence until you see a change. You have to completely discard the result and begin anew.

This works (I think), but only if the two flips are independent of each other, a non-trivial assumption.

Death panels in Texas

It’s a reasonable guess, don’t you think, that there’s a broad intersection between the folks shouting about “death panels” and the folks who would be inclined to support the decision of Texas and its governor to execute an innocent man?

Or did it?

James Galbraith in the Washington Monthly, reviewing David Wessel’s In Fed We Trust: Ben Bernanke’s War on the Great Panic.

Did Ben Bernanke really save America’s financial system?

…

Thus, in the phrase that forms the second subtitle of this book, “the Federal Reserve became the fourth branch of government.” And the system survived.Or did it?

…

The first question is: Did the system actually survive? It is true that checks still clear, that incipient runs on small banks and money markets were stopped, that neither the dollar nor the euro collapsed, and that the major commercial banks were not nationalized. But does all this add up to survival of finance capitalism as we knew it? Can we expect, with moderate passage of time, that households will resume borrowing, banks will resume lending, and that before long we will pick up the pattern of our economic lives as before?

Or does the fact that the Federal Reserve was prompted, in the heat of the crisis, to issue trillions of direct loans to private institutions fundamentally strip away the capitalist character of the system? Are we left with a system of large institutions of doubtful solvency, state dependent, unable to function without an implicit public guarantee, and therefore also needing government approval for their actions? If so, how is this system different from that in, say, the People’s Republic of China? Wessel notes that Chinese observers described the result as “socialism with American characteristics.” It’s not necessarily a joke.

Enough with the Nazis

Thus The Mudflats, whose father was a WW2 POW. Here’s the end.

… I remember as a child I was not allowed to watch Hogan’s Heroes. It wasn’t a joke in my house. There was nothing funny about prisoner of war camps. There were no handsome well-fed prisoners with secret tunnels under their bunks, and pirate radio equipment who always managed to play their captors for the fool. There were frightened, emaciated young men whose minds and bodies were broken an ocean away from home, who were shot on fences , and who ate cats, and watched their friends die. There was nothing to laugh about. Those were Nazis.

I am tired of people comparing Obama to Hitler. I am tired of seeing signs with swastikas and nazi symbols at health care rallies. I am tired of people saying that a health care plan designed to uplift millions of Americans to give them dignity, and choice and the ability to care for their families, is like Naziism. I am tired of Rush Limbaugh.

As time passes, and as the greatest generation becomes a memory, passing into history one soul at a time, it is up to the generations that follow them to keep “Hitler” and “Nazi” out of the clutches of those who would make them political buzzwords for people they don’t like, or policies they don’t understand. Those words remind us of the worst that people can be. There is nothing horrible about Germans in particular that caused them to do these things. This is humanity’s dark potential, and something that we all need to remember, whether we were there or not, or whether our family was affected or not, because this is what people can do to each other. To strip those words of their power and meaning in order to create political fear for self-gain is inexcusable and needs to be confronted and refuted whenever it arises, by all of us, whether we support the current health care bill and the current president or not.

Baltic Dry Index revisited

You remember back in December we looked at a graph of the then-collapsing Baltic Dry Index? Just out of general interest, here’s an update. (Click it for a larger view.)

Caltrain via Twitter

Most days, I ride Caltrain to work. Setting aside its insane policy (not entirely its fault) of cutting service and raising fares as a means of dealing with just about any problem, my main gripe is that it’s really hard to get any prompt information about service and schedule problems. This despite the installation a couple of years ago of a centralized electronic billboard system that ought to be able to provide this information to all platforms in real time.

Most days, I ride Caltrain to work. Setting aside its insane policy (not entirely its fault) of cutting service and raising fares as a means of dealing with just about any problem, my main gripe is that it’s really hard to get any prompt information about service and schedule problems. This despite the installation a couple of years ago of a centralized electronic billboard system that ought to be able to provide this information to all platforms in real time.

Well, technology to the rescue, just not Caltrain technology: Caltrain Tweets. The idea is this. Caltrain is full of passengers connected to the net (generally by mobile phone, since Caltrain has no wifi). Recruit those passengers as reporters, funnel the reports through Twitter (not forgetting the mobile-friendly version), and you’ve got a surprisingly effective real-time status system.

Here’s the feed so far this morning:

- NB 227 running 12 minutes late from Gilroy T07:31 less than a minute ago

- NB 211 5 mins late and counting at San Bruno T07:25 7 minutes ago

- NB313 stopped outside San Mateo, presumably waiting for single-trackers at Millbrae T07:24 7 minutes ago

- NB 313 stuck behind a broken down train. T07:24 8 minutes ago

- NB 313 stopped north of hillsdale T07:23 8 minutes ago

- SB 312 delayed at Millbrae, waiting to single track. T07:21 11 minutes ago

- Delays in San Mateo still affecting trains, 322 stopped in MBRAE T07:21 11 minutes ago

- SB208 is 14 minutes late arriving at Hayward Park. T07:13 19 minutes ago

- SB206 Just became a local train T06:32 about 1 hour ago

To use the service passively, just bookmark the main or mobile Twitter feed; no need for a Twitter account. The mobile feed works fine on my Palm Centro, whose web browser isn’t exactly state of the art.

To participate actively, visit the Caltrain Tweets and request a key that authorizes you to send your own messages (via email; again, no Twitter account required). (The key is a simple but effective measure to prevent spamming.) And next time you’re stuck on a late Caltrain (not all that common, but it happens), let the rest of us know; we’ll do the same for you.

Update: This was a busy morning, with several posts after those shown above. Simultaneously, here was the transit report from the SF Gate traffic site:

Transit: No Incidents Reported

511.org doesn’t even pretend to try.

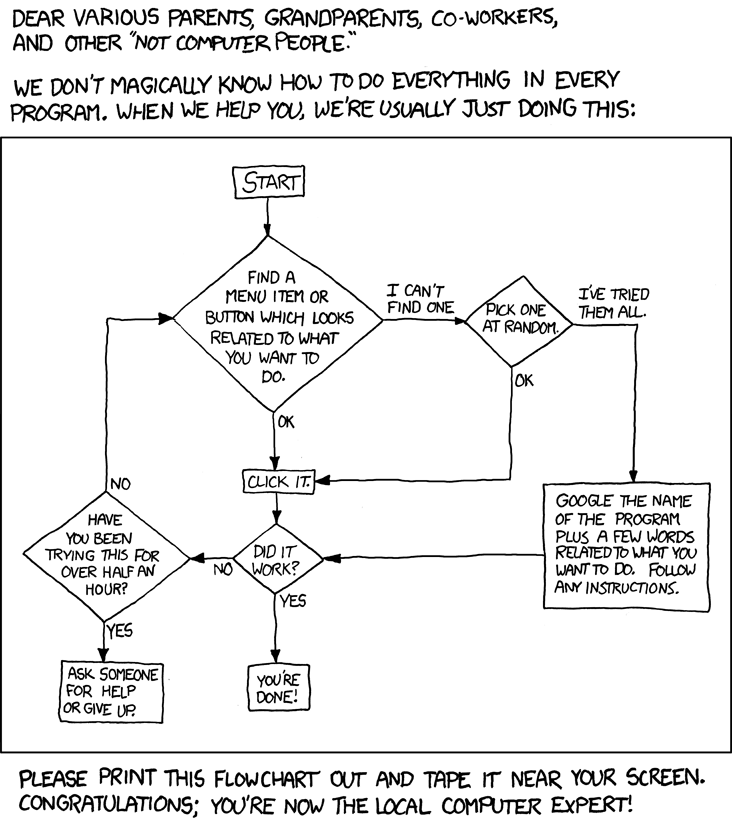

xkcd: Tech Support Cheat Sheet

You can generally trust xkcd to feed you the straight scoop. This piece is more than usually helpful. Listen, people: this is how we geeks do it. Really. Try this at home.

The power of myth

I was going to point to the Reid piece, but DougJ did the work for me. Reid, you may recall, reported the excellent Frontline documentary Sick Around the World, which you should watch if you have not already.

This piece, by T. R. Reid, does a pretty good job of dispelling right-wing myths about the horrors of health care in the rest of the first world. This kind of thing just breaks your heart as an American:

In Japan, waiting times are so short that most patients don’t bother to make an appointment. One Thursday morning in Tokyo, I called the prestigious orthopedic clinic at Keio University Hospital to schedule a consultation about my aching shoulder. “Why don’t you just drop by?” the receptionist said. That same afternoon, I was in the surgeon’s office. Dr. Nakamichi recommended an operation. “When could we do it?” I asked. The doctor checked his computer and said, “Tomorrow would be pretty difficult. Perhaps some day next week?”

It’s almost hard for me to believe this kind of thing, but I’ve seen it first-hand. When I was in France with my parents a few summers ago, my dad had a nasty flu and was afraid he might need medical attention if he didn’t improve soon. We called up and were told that a doctor could stop by the next morning if he still felt bad.

And we pay over 50% more per person for health care than Japan or France.

Everything we know about productivity is wrong

I’ve had a post from Matthew Yglesias lying around for several months. I’m not sure what to make of it all, except that much of our impression of economic “progress” for the last decade or so is illusory, most intriguingly productivity. This has implications beyond my depth.

The post comes from a presentation by Michael Mandel of Business Week.

But if the gains from Internet Decade productivity growth didn’t go to labor and didn’t go to capital, then where did they go? His thesis is that it largely didn’t exist at all. The extra money went into increased costs of health care (while wages have been flat, “total compensation” has gone up because employer-side health insurance premiums are higher) but health care isn’t actually dramatically better than it was ten years ago. Mandel doesn’t put it this way, but you can understand the situation as real, but modest, productivity gains being essentially offset by the decreasing productivity of the health care sector. Instead of really growing, we’ve just been borrowing from foreigners who were willing to invest on the theory that America was going to produce awesome innovations in the IT and biotech sectors that never really panned out.

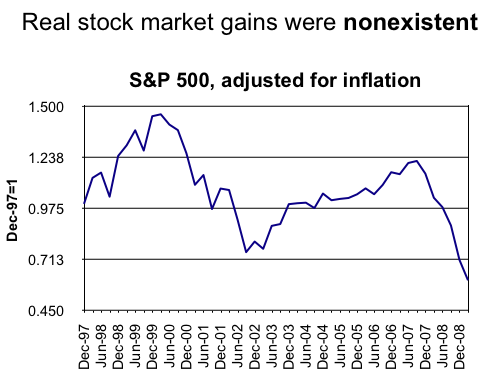

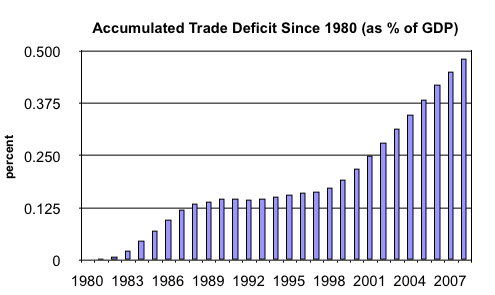

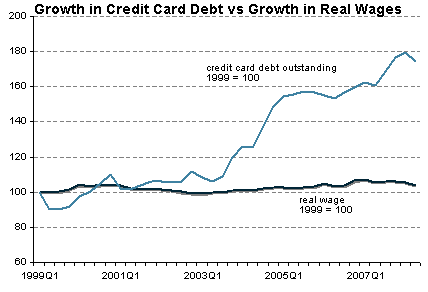

Herewith three of Mandel’s slides:

If I were more ambitious, or at least had more time on my hands, I’d look for data going back a little farther, 1950, say, or at least 1970. Stories about productivity growth have had great explanatory value. If they’re wrong, then we need new explanations.

Gloom from Yves Smith

This is a whole lot longer than I’d ordinarily be willing to quote entirely, but I feel justified because Ms Smith is obviously channeling me here.

Seriously, it’s a long, depressing list, and I can’t find anything in it to disagree with.

Yves Smith: Is This the Start of the Big One?

I don’t believe in market calls, and trying to time turns is a perilous game. But most savvy people I know have been skeptical of this rally, beyond the initial strong bounce off the bottom. It has not had the characteristics of a bull market. Volumes have been underwhelming, no new leadership group has emerged, and as greybeards like to point out, comparatively short, large amplitude rallies are a bear market speciality.

In addition, this one has had some troubling features. Most notable has been the almost insistent media cheerleading, particularly from atypical venues for that sort of thing, like Bloomberg. Investors who are not at all the conspiracy-minded sort wonder if there has been an official hand in the “almost nary a bad word will be said” news posture. Tyler Durden has regularly claimed that major trading desks have been actively squeezing shorts. There have been far too many days with suspicious end of session rallies.

The fall in the markets overnight, particularly the 5.8% drop in Shanghai, seems significant in combination with other factors:

More bank woes. We may be two thirds of the way through the losses, but it could also be as little as half. And despite the stress test baloney, the banking system is undercapitalized by a large margin. Even if the remaining writedowns are smaller in absolute terms than what is, past, they dig deeper into depleted equity bases. Colonial Bank, a $25 billion bank taken out last Friday, was deemed well capitalized until recently. We noted its much bigger neighbor, $140 billion Regions Bank, similarly deemed to be well capitalized, has effectively said it is insolvent How many other banks are broke save thanks to overly permissive accounting? And as we have noted before, the IMF in a study of 124 banking crises, found that regulatory forbearance, which is econ speak for letting the halt and lame limp along rather than taking them out, is far more costly, both in terms of lost growth and size of the ultimate bank recapitalization, than earlier action.

Consumers tapped out. The lousy retail sales report was a reminder of a rather central fact most have chosen to forget.

Foreclosures set to rise. We are not having a housing bounce. Some markets may be close to a bottom, but foreclosures grind on. Even if some local markets are at their nadir, there is so much overhang, between continuing mortgage stress and pent up sales, that much appreciation near term is unlikely. The record of past severe financial crises is that real estate takes over five years to bottom.

Fed in a box. Some e-mail chat pointed out a key fact: the term structure of US funding has gotten very short term. We have become in some ways like a massive bank, borrowing short and lending long. This means the idea of allowing rates to rise on the short end, which has to happen unless we stay in Japanese ZIRP land indefinitely, will be more disruptive than the Fed seems to appreciate.

More AIG losses, I am told more AIG losses are in the offing. There is still unused money out of the total alloted to the rescue, so any eruptions here may not require further official action, but it would have a bad impact on the collective mood, and further taint any efforts to shore up the financial system.

Lack of political leadership. The health care fiasco is going to be a defining event for Obama, in a negative way. His inability to respond effectively to simply absurd distortions of his plan and of the record of public supported programs overseas (including that many are government funded but still privately run, for instance) may dispel the illusion that he is or can be an effective leader. His banking policy, which is vital to recovery, became hostage to Geithner and Summer’s deep loyalty to the industry, and his lack or interest in rocking any boats. All Team Obama has done on the banking front is write a lot of blank check, hold some bogus “stress tests” in lieu of doing the real thing, and raise a stink on a few symbolic issues to try to paper over the failure to embark on real and badly needed reforms.

Ed Harrison has called him a black Herbert Hoover. If the economy takes another down leg, it will further confirm his inability to do anything other than compromise and try to spin it as success. The confidence game worked when he was a new President, but nice talk and not much action is already wearing thin. We could use someone at the helm who is willing to plot a course and stick with it, and instead what we have is someone long on charisma and short on resolve.