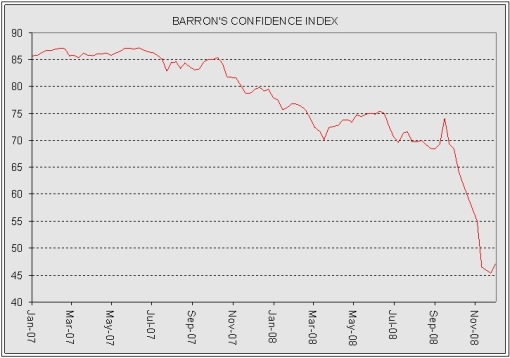

Lots of graphs today via Barry Ritholtz. Click the link for all of ’em, but here’s one. Is it bad news that the index is in the toilet? Good news that it’s ticked up?

Beats me.

Credit Crisis Watch (December 8, 2008)

Another indicator worth keeping an eye on is the Barron’s Confidence Index. This Index is calculated by dividing the average yield on high-grade bonds by the average yield on intermediate-grade bonds. The discrepancy between the yields is indicative of investor confidence. A declining ratio indicates that investors are demanding a higher premium in yield for increased risk. A slight improvement has taken place over the past week, but hardly of the magnitude to indicate restored confidence in the economy.