Presented as a public service.

Farhad Manjoo, Slate Magazine: How to kill time on the Web now that the election’s over

You’re welcome.

jonathan lundell

Presented as a public service.

Farhad Manjoo, Slate Magazine: How to kill time on the Web now that the election’s over

You’re welcome.

The Corner’s Mike Potemra.

It happened, almost too quickly, what everyone was waiting for. Is it really possible to sneak up on a crowd of many thousands of people? At 11 PM, the big-screen TV at the corner of 125th Street and Adam Clayton Powell Boulevard in Harlem went very briefly silent, and blank; and then a graphic silently popped up, “Barack Obama Elected 44th President.” It seemed to take forever for the crowd’s resulting murmur to coalesce into a shout, and then a roar. This was not a wish or a test pattern, this was it.

The scene was Congressman Charlie Rangel’s block party celebrating the election of Barack Obama. People of all races and ages were there on this mild Manhattan evening, and they were in a festive mood even before the big news was announced. American flags abounded; a platform preacher repeated “God bless America, God bless America.”

Why was I, a John McCain voter, there? A bit of personal history. I was born in 1964, and on the day I was born the U.S. Supreme Court ruled that Prince Edward County in Virginia had to reopen its public schools. The county had closed the schools because they decided it was better to have no public schools at all than to have to admit black kids into them. Here we are, just 44 years later, with an African-American president, a president elected with the electoral votes of that very same Commonwealth of Virginia.

I voted for John McCain because I admire him immensely as a person, and agree with him on many more issues than I do with Senator Obama. And I ask a rhetorical question: Can we McCain voters, without embarrassment, shed a tear of patriotic joy about the historic significance of what just happened? And I offer a short, rhetorical answer.

Yes, we can.

Or so says the Boston Fed, disagreeing with the Minnesota Fed folks (see my earlier post). Here’s a summary; get the pdf here.

Looking Behind the Aggregates: A reply to “Facts and Myths about the Financial Crisis of 2008, Working Paper No. QAU08-5, by Ethan Cohen-Cole, Burcu Duygan-Bump, Jose Fillat, and Judit Montoriol-Garriga, Federal Reserve Bank of Boston

Abstract As Chari et al (2008) point out in a recent paper, aggregate trends are very hard to interpret. They examine four common claims about the impact of financial sector phenomena on the economy and conclude that all four claims are myths. We argue that to evaluate these popular claims, one needs to look at the underlying composition of financial aggregates. Our findings show that most of the commonly argued facts are indeed supported by disaggregated data.

Overview The US and world economies are in the midst of a severe financial crisis. The crisis is undoubtedly linked in some fashion to financial institutions. The fundamental question Chari et al (2008), henceforth CCK, seek to address is the degree to which varied claims about the way the crisis affects the real economy are true.

CCK make two primary arguments. First, they argue that a set of four now common claims about the nature of the crisis are false. Second, they assert that interest rate spreads, in particular the spread between the London Interbank Offered Rate (LIBOR) and the fed funds rate may be informative about the cost of borrowing during normal times, but misleading during crises as the increased spreads may be “due to the drop in the real return to Treasury securities as a result of the flight to quality and does not constitute an increase in the real cost of borrowing.”

In this short note, we consider their first argument and present further evidence on the four claims that are examined in CCK. Using publicly available data, we show that these facts are indeed true and not mythical. Their second argument on spreads remains a more theoretical one that we leave for another short note. …

Conclusion Our analysis has shown that the claims regarding the financial markets and the mechanism through which they may affect the real economy are largely supported by looking behind the aggregates of publicly available data. Having said so, we would like to point out the need for a more thorough analysis than the simple plots we have provided here. After all, there are many other confounding factors that make interpretation of these numbers difficult. For example, it is hard to even understand what it means to observe a decrease in lending. Simple plots cannot help us disentangle the extent to which changes in new bank lending are caused by banks cutting lending or by decreased demand for loans due to a slow-down in the real economy.

Given that both the US and the world economies are undergoing a financial crisis, we emphasize, along with CCK, the need for ample data and analyses to support policy decisions. We encourage future studies. …

Zubin Jelveh lays out the argument, concluding:

What’s the upshot here? Frankly, it’s hard for me to tell. Both papers are right, depending on which universe of data is your poison. But the most important takeaway would appear to be that it’s a mistake to think the Minn. Fed’s conclusions mean there’s been little or no impact on nonfinancial firms from the credit crunch.

via Mark Thoma

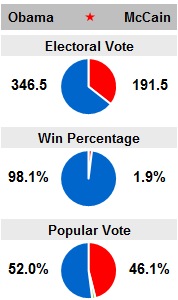

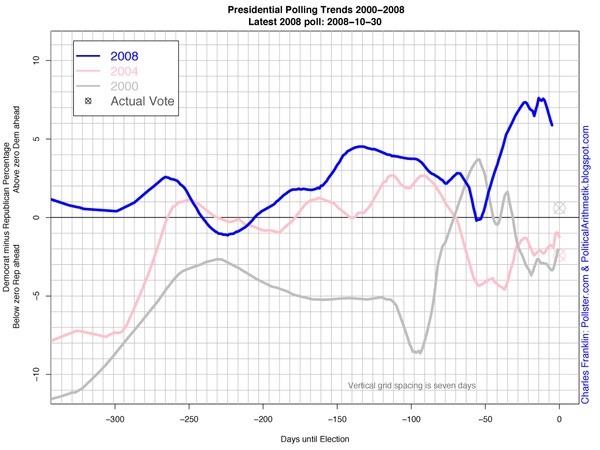

Sam Wang, of the Princeton Election Consortium, weighs in with a final prediction of today’s vote.

PRESIDENT

Electoral vote: The final polling snapshot is Obama 352 EV, McCain 186 EV. The confidence bands are 68% [337,367] Obama EV, 95% [316,378] Obama EV.

Bias analysis: I expect cell phone users missing from landline surveys to give Obama a 1% boost. Based on the bias adjustment I gave you earlier, this scenario brings the median to a level that is still within the 68% confidence band above. I use it as my personal prediction: Obama 364 EV, McCain 174 EV.

Popular vote: The median Obama-McCain margin is Obama +7.0+/-0.8% (n=9, 10/31-11/2). The error bar incorporates assignment of undecided voters. My final prediction is Obama 53%, McCain 46%, third-party candidates 1%.

Over at 538, I don’t see Nate Silver’s “official” prediction (does he do that?), but here’s today’s summary graphic:

I’ve been on the road, so my long-anticipated first taste of this year’s  Sierra Nevada Celebration Ale was a little late this year. SNCA is Sierra Nevada’s seasonal IPA, and each year we have a small variation on a familiar theme. This year’s SNCA is the most intense I can remember.

Sierra Nevada Celebration Ale was a little late this year. SNCA is Sierra Nevada’s seasonal IPA, and each year we have a small variation on a familiar theme. This year’s SNCA is the most intense I can remember.

Pick some up for election day, either for its nominal purpose or to drown your sorrows. You won’t regret it.

John Wildermuth in the SF Chronicle:

The signs on the front lawn of former 49er quarterback Steve Young’s Peninsula home say “No on Prop. 8,” which normally wouldn’t be much of a story in the Bay Area, a gay-friendly region which is the center of opposition to the effort to ban same-sex marriage in the state.

But Young isn’t only a Hall of Fame quarterback. He’s also the great-great-great grandson of Brigham Young, the second president of the Mormon church. The church has pushed hard and publicly for Prop. 8 and Mormons have pumped millions into the campaign.

…

Young also isn’t just any church member. During his years in the NFL, he was one of the nation’s most visible Mormons. He graduated from BYU, which was named for his ancestor, and received his law degree there. In a 1996 “60 Minute” interview, he said that he still had plans to go on the church mission he missed in college and had no problem tithing 10 percent of his earnings to the church. He retains close ties to Utah, married his wife, Barbara, at a temple in Hawaii and even served as narrator for a short video on the Mormon church and its history, done for the 2002 Winter Olympics in Utah.

Given all that, it’s surprising to see Young’s family lining up on the opposite side of the church, especially after Mormon leaders in Salt Lake City sent a letter last June that asked all California church members to do all they could to support the Prop. 8 effort by “donating of your means and time to assure that marriage in California is legally defined as being between a man and a woman.”

While it’s Barb Young’s name that appears on the checks, she made it clear in a statement issued today through Equality California that the contributions are a family affair.

“We believe ALL families matter and we do not believe in discrimination, therefore, our family will vote against Prop. 8,” she said.

via Bob Morris

Thus Mike Meyers in the Star Tribune:

The nation indeed may be facing a financial crisis, with large institutions failing in the wake of multibillion debts, but most bank-lending to business customers actually has been on the rise.

“The story goes that they [banks] are holding on to the money or putting it into Treasury bills,” said Lawrence Christiano, a Northwestern University economist and consultant to the Federal Reserve Bank of Minneapolis. “That seems to fly directly into the face of the evidence that’s out there.”

The latest government numbers, through mid-October, show bank commercial and industrial loans up, bank commercial real estate loans rising and interbank loans climbing. Indeed, from September 2007 to mid-October of this year, the numbers in all three categories have climbed consistently.

…

Four claims about the nature of the nation’s financial crisis appear to be myths, [Chari, Lawrence Christiano, a Northwestern University economist and consultant to the Federal Reserve Bank of Minneapolis, and University of Minnesota economist Patrick Kehoe] concluded.

Their findings:

- Bank lending to corporate America and individuals has not declined.

- Lending between banks has not dried up.

- Commercial paper (short-term borrowing by nonfinancial companies) has fallen, but not seized up as a source of commercial lending. (Indeed, commercial-paper levels last week started to head back up for the first time since the failure of Lehman Brothers, in mid-September.)

- Banks do not, as popularly believed, play a large role in channeling money from savers to borrowers.

I’m skeptical, frankly, but an explanation would be welcome.

via Open Left

One of the pleasures of an October visit to Minnesota is a visit to the local apple orchards. In large part, this is due to a century of apple breeding at the University of Minnesota, whose apple program reminds me of the wine-grape-breeding program at UC Davis, closer to where I live.

One of the pleasures of an October visit to Minnesota is a visit to the local apple orchards. In large part, this is due to a century of apple breeding at the University of Minnesota, whose apple program reminds me of the wine-grape-breeding program at UC Davis, closer to where I live.

UMN’s latest blockbuster variety is the Honeycrisp, which showed up in California supermarkets last year, but was already well-known in the midwest.

My personal favorite, though, is the Prairie Spy, which dates back to the 1940s. My taste here runs to a hard, tart apple, not all that sweet; I seem to be in a minority. I’ve got no quarrel with the Honeycrisp, though, which manages to be sweetly tart and, well, nicely apple-flavored.

There are plenty of orchards around here (I’m writing in St Louis Park, just west of Minneapolis) where you can sample dozens of variety and take your favorites home. I’ll be visiting Sponsel’s Minnesota Harvest this afternoon, one of my favorites, with a stunning variety of apple varieties on offer.

Bailing Out Homeowners: What Does It Mean?

…

As everyone should know now, the basic problem is that tens of millions of people (urged on by bankers, financial advisers, economists, and politicians) bought homes at bubble inflated prices. The bubble is now bursting so tens of millions of people now live in homes that are worth substantially less than what they paid, and in most of these cases, much less than what they owe on their home.

…

One point on which it should be possible to agree is that we should want the bubble to deflate as quickly as possible. While many economists have hugely exaggerated the problem caused by deflation (who cares if prices are rising 0.5 percent a year or falling 0.5 percent a year?), there is a real problem associated with falling house prices. Declining house prices mean that the people who buy homes in the current market will see a loss on their home. If they can’t absorb this loss, then the bank that makes the loan (or whoever holds it) will absorb the loss. Rather than a program of house price supports, the country would be best served by a crash the bubble policy.The big problem in this story is that the folks who somehow could not see the largest housing bubble in the history of the world are still running economic policy. Unlike custodians and dishwashers, economists are not held accountable for their job performance. For this reason, we should expect many tough times ahead.

—Dean Baker

Apropos Baker’s argument, and via Barry Ritholtz, we have this WSJ graphic (click it for a larger interactive version) on the real estate disaster across much of California.

Dean Baker.

The Recession Is Not Caused by the Credit Crunch!!!!!!!

NPR just reported on Morning Edition that the markets are plummeting because investors are realizing the seriousness of the damage caused by the credit crunch. This calls for an extra long arghhhhhhhhhhhhhhhhh!!!!!!!!!!!!!!!!

The economy is not in a recession because of the credit crunch. The economy is going into a recession because of the crash of the housing bubble. Homeowners are losing on the order of $8 trillion in housing bubble wealth, $110,000 per homeowner. For most families, this is most of their wealth.

It was this housing bubble wealth that drive consumption and pushed the savings rate to near zero over the last four years. Now this wealth is disappearing and people are cutting back their consumption. In many cases they no longer have the ability to consume, since many households were borrowing directly against their home equity to finance their consumption. In other cases, they now realize the need to save, since they are approaching retirement and have nothing to rely upon other than their Social Security.

NPR completely missed the housing bubble on the way up. They relied almost exclusively on economists that did not know what they were talking about. Can’t they find an economist who at least now can recognize the impact of the collapse of the housing bubble? The horror, the horror.

—Dean Baker

Add Apple to the list of companies actively opposing California’s Proposition 8:

No on Prop 8

October 24, 2008

Apple is publicly opposing Proposition 8 and making a donation of $100,000 to the No on 8 campaign. Apple was among the first California companies to offer equal rights and benefits to our employees’ same-sex partners, and we strongly believe that a person’s fundamental rights — including the right to marry — should not be affected by their sexual orientation. Apple views this as a civil rights issue, rather than just a political issue, and is therefore speaking out publicly against Proposition 8.

Update (speaking of Silicon Valley): Tom Campbell:

Republicans believe deeply that government should be limited. Government has no business making distinctions between people based on their personal lives. That’s why, as a Californian and a Republican who has held elective office at the federal and state levels, I will be voting No on Proposition 8.

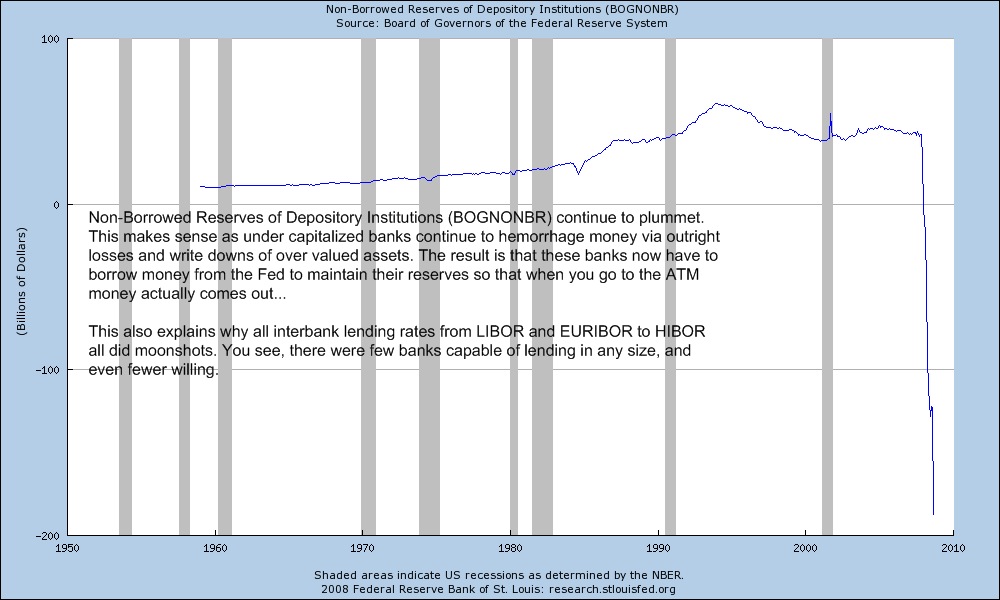

Lots more where that came from, courtesy of Ben Bittrolff.

My takeaway: you don’t have to know much about economics (which I certainly don’t) to see that something very unusual is going on, and it hasn’t even started heading back to normal.

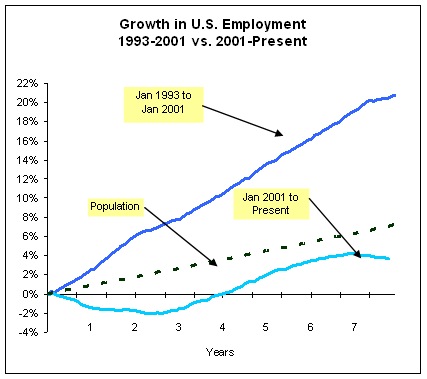

Here’s a nice graphic depiction of why slow employment growth isn’t really growth at all if it doesn’t keep pace with population growth.

via Ben Furnas

Which I haven’t seen. Follow the review link for a readable lesson in political economics.

In case you’ve missed the hype, IOUSA is a documentary making the case that the U.S. budget is hopelessly out of control and that our current spending patterns will bankrupt our children. The film features such noteworthy characters as Alan “Bubbles” Greenspan, Robert “Don’t Regulate Credit Default Swaps” Rubin, and former presidential candidate Ron Paul.

This film should be viewed as part of a larger effort to dismantle Social Security and Medicare, the country’s core safety net programs. The reality is that our budget is essentially fine, it is our health care system that is out of control. But fixing health care would require going after the drug companies, the insurance companies, and highly paid medical specialists. But those folks are all powerful, so the IOUSA crew went after old people instead.

You can get CEPR’s movie review here.

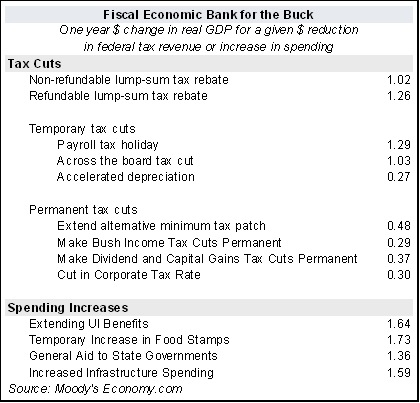

Now that there’s talk of a second stimulus package floating around (and we’d have to think it’s likely), it’s interesting to go back and look at this chart of the effectiveness of various stimulus options, as calculated by Moody’s Economy.com last January.

The measure is the efficiency of each option in boosting GDP, in dollars of GDP per dollar of tax cut or spending increase.

The accompanying article has more detail, including a discussion of why an extension of unemployment insurance (UI) benefits or increased food stamps has more effect than simple tax cuts for rebates.

A long and pessimistic report by Nir Rosen in Rolling Stone, after and about a harrowing trip into Taliban-held Afghanistan. Iraq was (and is) bad enough, and Afghanistan is not Iraq. I’ll quote a bit of it here, but do read the whole thing.

[Dr. Khalil] joined the Taliban early, eventually serving as a commander in a northern district. He says he is fighting to restore a government of Islamic law, but that Mullah Omar does not have to be the leader again. God willing, he adds, it will take no more than 30 years to rid Afghanistan of foreigners.

…

The Bush administration is placing its hopes on presidential elections in Afghanistan next year, but everyone I speak with in Kabul agrees that the elections will be a joke. “The Americans are gung-ho about elections,” a longtime nongovernmental official tells me. “But it will only exacerbate ethnic tensions.” In Pashtun areas controlled by the Taliban, registration would be virtually impossible, and voting would invoke a death sentence — effectively disenfranchising the country’s dominant ethnic group. “You can’t fix the insurgency with an election,” a senior U.N. official tells me. “It’s a socioeconomic phenomenon that goes well beyond the border of Afghanistan.” Real elections would require the cooperation of the Taliban — and that, in turn, would require negotiations with the Taliban. The war, in effect, is already lost.

“This can’t be solved other than by talking to the Taliban,” says a top diplomat in Kabul. A leading aid official adds that it is important to understand the ideological goal of the Taliban: “They don’t have an international-terrorist agenda — they have an Afghanistan agenda. We might not agree with their agenda for the country, but that’s not our war.” Former Taliban leaders agree that only talks will end the war. “If the U.S. deals with Pakistan and negotiates with higher-level Taliban,” says one, “then it could reach a deal.”

ADVERTISEMENT

Negotiating with the Taliban would also enable the Americans to take advantage of the sharp divisions within the insurgency. Mullah Omar, the Taliban leader, has been openly criticized by a rival named Siirajudin Haqqani, who has called for Omar to be replaced. In provinces like Ghazni, the Taliban leadership is now divided between commanders loyal to Omar and men who follow Haqqani. A recent meeting between supporters of the two men in the Pakistani city of Peshawar reportedly descended into fighting when an Omar official threw his tea glass at a Haqqani man. The internal split provides an opening — if U.S. intelligence is smart enough to exploit it.

“The U.S. should try to weaken the Taliban,” a former Taliban commander tells me. “They should make groups, divide and conquer. If someone wants to use the division between Haqqani and Omar, they can.”The Bush administration believes it can stop the Taliban by throwing money into clinics and schools. But even humanitarian officials scoff at the idea. “If you gave jobs to the Viet Cong, would they stop fighting?” asks one. “Two years ago you could build a road or a bridge in a village and say, ‘Please don’t let the Taliban come in.’ But now you’ve reached the stage where the hearts-and-minds business doesn’t work.”

Officials on the ground in Afghanistan say it is foolhardy to believe that the Americans can prevail where the Russians failed. At the height of the occupation, the Soviets had 120,000 of their own troops in Afghanistan, buttressed by roughly 300,000 Afghan troops. The Americans and their allies, by contrast, have 65,000 troops on the ground, backed up by only 137,000 Afghan security forces — and they face a Taliban who enjoy the support of a well-funded and highly organized network of Islamic extremists. “The end for the Americans will be just like for the Russians,” says a former commander who served in the Taliban government. “The Americans will never succeed in containing the conflict. There will be more bleeding. It’s coming to the same situation as it did for the communist forces, who found themselves confined to the provincial capitals.”

Simply put, it is too late for Bush’s “quiet surge” — or even for Barack Obama’s plan for a more robust reinforcement — to work in Afghanistan. More soldiers on the ground will only lead to more contact with the enemy, and more air support for troops will only lead to more civilian casualties that will alienate even more Afghans. Sooner or later, the American government will be forced to the negotiating table, just as the Soviets were before them.

“The rise of the Taliban insurgency is not likely to be reversed,” says Abdulkader Sinno, a Middle East scholar and the author of Organizations at War in Afghanistan and Beyond. “It will only get stronger. Many local leaders who are sitting on the fence right now — or are even nominally allied with the government — are likely to shift their support to the Taliban in the coming years. What’s more, the direct U.S. military involvement in Afghanistan is now likely to spill over into Pakistan. It may be tempting to attack the safe havens of the Taliban and Al Qaeda across the border, but that will only produce a worst-case scenario for the United States. Attacks by the U.S. would attract the support of hundreds of millions of Muslims in South Asia. It would also break up Pakistan, leading to a civil war, the collapse of its military and the possible unleashing of its nuclear arsenal.”

In the same speech in which he promised a surge, Bush vowed that he would never allow the Taliban to return to power in Afghanistan. But they have already returned, and only negotiation with them can bring any hope of stability. Iraq, Afghanistan and Pakistan “are all theaters in the same overall struggle,” the president declared, linking his administration’s three greatest foreign-policy disasters in one broad vision. In the end, Bush said, we must have “faith in the power of freedom.”

But the Taliban have their own faith, and so far, they are winning. On my last day in Kabul, a Western aid official reminds me of the words of a high-ranking Taliban leader, who recently explained why the United States will never prevail in Afghanistan.

“You Westerners have your watches,” the leader observed. “But we Taliban have time.”

via Juan Cole

From the Guardian. If the find pans out (or whatever the oil-prospecting term is), the political and economic implications are profound. Per capita, that’s a lot of oil.

20bn barrel oil discovery puts Cuba in the big league

Friends and foes have called Cuba many things – a progressive beacon, a quixotic underdog, an oppressive tyranny — but no one has called it lucky, until now.

Mother nature, it emerged this week, appears to have blessed the island with enough oil reserves to vault it into the ranks of energy powers. The government announced there may be more than 20bn barrels of recoverable oil in offshore fields in Cuba’s share of the Gulf of Mexico, more than twice the previous estimate.

If confirmed, it puts Cuba’s reserves on par with those of the US and into the world’s top 20. Drilling is expected to start next year by Cuba’s state oil company Cubapetroleo, or Cupet.