If you’re wondering what this post is about, you should probably just skip it.

Last week I was reconfiguring my home network, mainly to get better signal distribution and to enable Apple’s guest network facility. As part of the reconfiguration, I added a WPA2 password to the previously unsecured main network (we’re talking a recent dual-band AirPort Extreme here).

When I was done, everything was working fine, except that while both my iPad (iOS 3.2.2) and iPhone 4 (iOS 4.1) would connect OK, after a minute or three they’d drop off the network, and fail to reconnect. If I reconnected manually, sometimes I’d have to reenter the password, sometimes not. Disabling WPA2 (so no password) made everything work.

I googled up several proposed solutions, but they weren’t applicable, or didn’t help. Eventually, though, I found the iPhone solution: in the Settings app, under Wi-Fi, display the details for the current network and press the “Forget this Network” button. Reestablish the connection, and all is well.

On my iPad, though, there was no “Forget this Network” button. Instead, there was a slide switch labelled “Auto-Join” that was turned off. I could turn it on, but the setting never stuck; it was always off when I returned to the page. This, it turns out, was a hot clue, but I didn’t know enough to recognize it.

Some more googling, and I found a suggestion to go to the General tab of the Settings app, and thence to the Reset page and click “Reset Network Settings”. After that, back on the Settings Wi-Fi tab network details, the Auto-Join switch had disappeared, replaced by the same “Forget this Network” button I saw on the iPhone.

I reestablished the connection, and it’s been fine ever since.

Clearly there’s some kind of problem associated with one of the firmware upgrades from 3.2 to 3.2.1 to 3.2.2. My suggestion, even if you’re not seeing my symptom, is to make sure you’ve got a “Forget this Network” button rather than an “Auto-Join” switch, and if you don’t, reset your network settings. It’s a minor pain, since you’ll have to reenter Wi-Fi network settings, but it likely will prevent future problems. (It has no apparent effect on the AT&T network connection; at least I didn’t have to do anything special; it just kept working.)

One more note, only tangentially related. The Wi-Fi signal strength indicator on a MacBook Pro shows full strength even with rather weak signals. I used iStumbler, along with option-clicking on the Wi-Fi fan icon, to see the actual signal strength. Getting a stronger signal solved another problem I was having—random, infrequent loss of Wi-Fi connection on one of our MBPs, the one farthest from the base station.

William James’ third son, Herman, died of whooping cough at the age of 18 months. Some 22 years later, James wrote in Pragmatism (he was 65):

William James’ third son, Herman, died of whooping cough at the age of 18 months. Some 22 years later, James wrote in Pragmatism (he was 65):

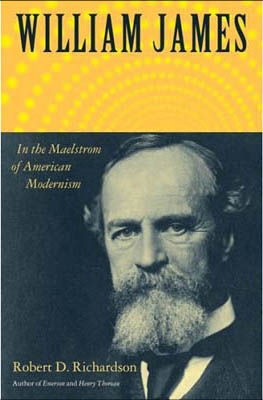

I also wanted to mention a relatively recent (2006) biography, William James: In the Maelstrom of American Modernism. I picked up a hardcover copy from a bargain table in Minneapolis a year ago, and have been working my way through it ever since. It’s a reflection on my reading habits, not the quality of the writing, that a year later I’m only halfway through.

I also wanted to mention a relatively recent (2006) biography, William James: In the Maelstrom of American Modernism. I picked up a hardcover copy from a bargain table in Minneapolis a year ago, and have been working my way through it ever since. It’s a reflection on my reading habits, not the quality of the writing, that a year later I’m only halfway through.