‘Lost’ music instrument recreated

New software has enabled researchers to recreate a long forgotten musical instrument called the Lituus.

The 2.7m (8.5ft) long trumpet-like instrument fell out of use some 300 years ago.Bach’s motet (a choral musical composition) “O Jesu Christ, meins lebens licht” was one of the last pieces of music written for the Lituus.

Now, for the first time, this 18th Century composition has been played as it might have been heard.

Researchers from the Engineering and Physical Sciences Research Council (EPSRC) and the University of Edinburgh collaborated on the study. …

Category: History

1968 is ancient history

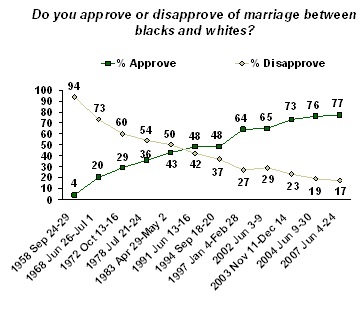

So I was catching up on On the Media this morning, and heard this bit buried in a piece on the movement of public opinion toward approval of gay marriage.

… if we look back at interracial marriage, it was initially only at a 19 percent support level in 1968, one year after the Supreme Court, the U.S. Supreme Court, had acted in this issue.

19%! 1968! That seems crazy to me (I was in college at the time); 1968 is only yesterday, isn’t it?

On the other hand, 41 years seemed like a lot longer back then; in 1968 that would have been 1927, which, of course, is ancient history, right?

It has been said of predicting technological progress that we tend to overestimate advances in the short term and underestimate them in the long. That seems right to me, and the cases seems somewhat similar. Year to year, change happens at a glacial pace. Yet glaciers do move.

Having written the above, I did a quick search on the subject of public attitude toward interracial marriage. Here’s what Gallup finds:

Notice that there wasn’t even a plurality supporting interracial marriage until 1991 (now that is just yesterday).

I didn’t find such a concise presentation on same-sex marriage, and the data are harder to compare, since polls have been talking about both marriage and civil unions. But there’s a pretty good overview here. Two trends jump out at me. One is that opposition, especially strong opposition, to gay marriage is steadily dropping. The other is a dramatic age difference; one poll in 2008 found 69–22% opposition for gay marriage by respondents over 65, but 51–40% support by those 18–34.

In Anne Lamott’s words, “In a hundred years? — all new people!”

Just following orders

Those of us who grew up in the shadow of WW2 surely remember the contempt with which the “just following orders” defense was met. From the Nuremberg principles:

Article 7. The official position of defendants, whether as Heads of State or responsible officials in Government Departments, shall not be considered as freeing them from responsibility or mitigating punishment.

Article 8. The fact that the Defendant acted pursuant to order of his Government or of a superior shall not free him from responsibility, but may be considered in mitigation of punishment if the Tribunal determines that justice so requires.

Suddenly it’s all, “never mind”? Isn’t anyone even a little embarrassed at mounting this defense some 60 years later?

via Hullabaloo

More from Glenn Greenwald.

…the next time you’re pulled over by a police officer for speeding, quote Barack Obama: “This is a time for reflection, not retribution.” See if that works. If not, move to: “It’s time to focus on the future, not look to the past.” Criminal defense attorneys should try that on juries and judges, too.

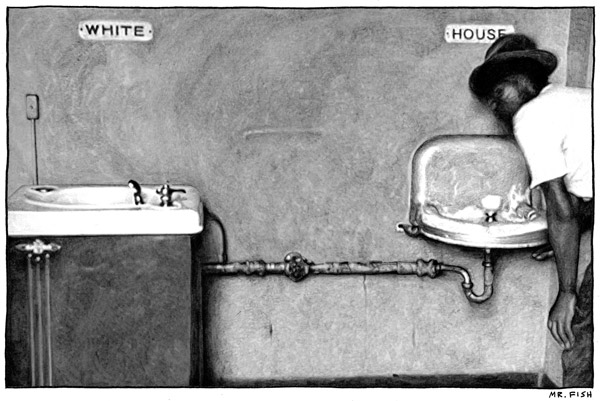

The Obvious Comparison

Hilzoy, at the Washington Monthly.

You would like to place Zubaydah in a cramped confinement box with an insect. You have informed us that he appears to have a fear of insects. (…) As we understand it, you plan to inform Zubaydah that you are going to place a stinging insect into the box, but you will actually place a harmless insect in the box, such as a caterpillar. If you do so, to ensure you are outside the predicate death requirement, you must inform him that the insects will not have a sting that would produce death or severe pain. If, however, you were to place the insect in the box without informing him that you are doing so, you should not affirmatively lead him to believe that any insect is present which has a sting that could produce severe pain or suffering or even cause his death.”

—OLC memo of August 1, 2002, signed by Jay Bybee.

“‘You asked me once,’ said O’Brien, ‘what was in Room 101. I told you that you knew the answer already. Everyone knows it. The thing that is in Room 101 is the worst thing in the world.’

“The door opened again. A guard came in, carrying something made of wire, a box or basket of some kind. He set it down on the further table. Because of the position in which O’Brien was standing. Winston could not see what the thing was.

‘The worst thing in the world,’ said O’Brien, ‘varies from individual to individual. It may be burial alive, or death by fire, or by drowning, or by impalement, or fifty other deaths. There are cases where it is some quite trivial thing, not even fatal.’

He had moved a little to one side, so that Winston had a better view of the thing on the table. It was an oblong wire cage with a handle on top for carrying it by. Fixed to the front of it was something that looked like a fencing mask, with the concave side outwards. Although it was three or four metres away from him, he could see that the cage was divided lengthways into two compartments, and that there was some kind of creature in each. They were rats.

‘In your case,’ said O’Brien, ‘the worst thing in the world happens to be rats.'”

—George Orwell, 1984

Barcelona 1908

Filmed by Ricardo Baños. See also San Francisco 1906.

via Sam Smith

Obama as Hoover

Edward Harrison at Naked Capitalism.

Barack Obama as Herbert Hoover

Edward Harrison here. For months now, we have been hearing the Obama — FDR comparisons, all suggesting that Barack Obama is a modern day Franklin Delano Roosevelt, with the opportunity to lead us out of Depression with a new New Deal. I have some serious problems with this comparison. In my view, a comparison between Barack Obama and Herbert Hoover is more apt. …

… This recession turned into the Great Depression, with the economy hitting bottom in March 1933. So, the entire recession we remember as being the depths of the Great Depression occurred while Herbert Hoover was President, not during FDR’s presidency. …

Why does this matter? Go read the post.

Banking for the 21st Century

Stephen Labaton, NY Times, 1999, via Sam Smith.

Congress approved landmark legislation today that opens the door for a new era on Wall Street in which commercial banks, securities houses and insurers will find it easier and cheaper to enter one another’s businesses.

The measure, considered by many the most important banking legislation in 66 years, was approved in the Senate by a vote of 90 to 8 and in the House tonight by 362 to 57. The bill will now be sent to the president, who is expected to sign it, aides said. It would become one of the most significant achievements this year by the White House and the Republicans leading the 106th Congress.

“Today Congress voted to update the rules that have governed financial services since the Great Depression and replace them with a system for the 21st century,” Treasury Secretary Lawrence H. Summers said. “This historic legislation will better enable American companies to compete in the new economy.”

The decision to repeal the Glass-Steagall Act of 1933 provoked dire warnings from a handful of dissenters that the deregulation of Wall Street would someday wreak havoc on the nation’s financial system. The original idea behind Glass-Steagall was that separation between bankers and brokers would reduce the potential conflicts of interest that were thought to have contributed to the speculative stock frenzy before the Depression…

Administration officials and many Republicans and Democrats said the measure would save consumers billions of dollars and was necessary to keep up with trends in both domestic and international banking. Some institutions, like Citigroup, already have banking, insurance and securities arms but could have been forced to divest their insurance underwriting under existing law. Many foreign banks already enjoy the ability to enter the securities and insurance industries…

Consumer groups and civil rights advocates criticized the legislation for being a sop to the nation’s biggest financial institutions. They say that it fails to protect the privacy interests of consumers and community lending standards for the disadvantaged and that it will create more problems than it solves.

The opponents of the measure gloomily predicted that by unshackling banks and enabling them to move more freely into new kinds of financial activities, the new law could lead to an economic crisis down the road when the marketplace is no longer growing briskly.

“I think we will look back in 10 years’ time and say we should not have done this but we did because we forgot the lessons of the past, and that that which is true in the 1930’s is true in 2010,” said Senator Byron L. Dorgan, Democrat of North Dakota. “I wasn’t around during the 1930’s or the debate over Glass-Steagall. But I was here in the early 1980’s when it was decided to allow the expansion of savings and loans. We have now decided in the name of modernization to forget the lessons of the past, of safety and of soundness.”

Senator Paul Wellstone, Democrat of Minnesota, said that Congress had “seemed determined to unlearn the lessons from our past mistakes.”

“Scores of banks failed in the Great Depression as a result of unsound banking practices, and their failure only deepened the crisis,” Mr. Wellstone said. “Glass-Steagall was intended to protect our financial system by insulating commercial banking from other forms of risk. It was one of several stabilizers designed to keep a similar tragedy from recurring. Now Congress is about to repeal that economic stabilizer without putting any comparable safeguard in its place.”

Others said the legislation was essential for the future leadership of the American banking system.

“If we don’t pass this bill, we could find London or Frankfurt or years down the road Shanghai becoming the financial capital of the world,” said Senator Charles E. Schumer, Democrat of New York. “There are many reasons for this bill, but first and foremost is to ensure that U.S. financial firms remain competitive.”…

One Republican Senator, Richard C. Shelby of Alabama, voted against the legislation. He was joined by seven Democrats: Barbara Boxer of California, Richard H. Bryan of Nevada, Russell D. Feingold of Wisconsin, Tom Harkin of Iowa, Barbara A. Mikulski of Maryland, Mr. Dorgan and Mr. Wellstone.

In the House, 155 Democrats and 207 Republicans voted for the measure, while 51 Democrats, 5 Republicans and 1 independent opposed it. Fifteen members did not vote…

Why not ‘Joshua Christ’?

Brian Palmer in Slate.

Was Jesus a common name back when he was alive?

… The long version of the name, Yehoshua, appears another few hundred times, referring most notably to the legendary conqueror of Jericho (and the second most famous bearer of the name). So why do we call the Hebrew hero of Jericho Joshua and the Christian Messiah Jesus? Because the New Testament was originally written in Greek, not Hebrew or Aramaic. Greeks did not use the sound sh, so the evangelists substituted an S sound. Then, to make it a masculine name, they added another S sound at the end. The earliest written version of the name Jesus is Romanized today as Iesous. (Thus the crucifix inscription INRI: “Iesus Nazarenus Rex Iudaeorum,” or “Jesus of Nazareth, King of the Jews.”)

The initial J didn’t come until much later. That sound was foreign to Aramaic, Hebrew, Greek, and Latin. Not even English distinguished J from I until the mid-17th century. Thus, the 1611 King James Bible refers to Jesus as “Iesus” and his father as “Ioseph.” The current spelling likely came from Switzerland, where J sounds more like the English Y. When English Protestants fled to Switzerland during the reign of the Catholic Queen Mary I, they drafted the Geneva Bible and used the Swiss spelling. Translators in England adopted the Geneva spelling by 1769. …

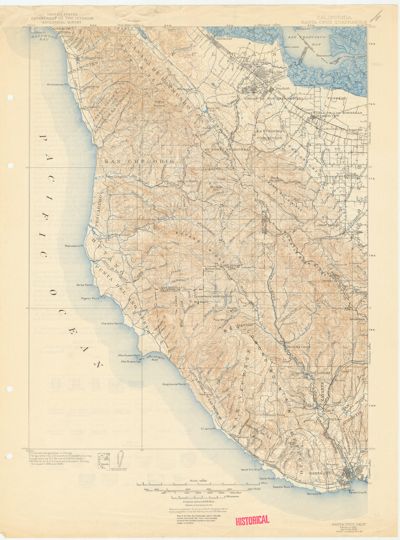

USGS historical maps

The USGS has a nice collection of scanned historical maps of the San Francisco Bay Area. Here’s the one I was after, a c1902 map of the area where I now live.

These maps are available in medium-resolution JPEGs (this one at 1600×2161) and higher-resolution MrSID files (this one at 6614×8933). Mac users can use a free plugin for GraphicConverter to view and convert MrSID files.

Go Illini!

Interesting historical footnote in this Slate Explainer.

Can Rod Blagojevich still appoint a replacement senator?

…

Even if Blagojevich makes his pick before any state-level action can be taken, the buck stops with the U.S. Constitution, which states: “Each House shall be the judge of the elections, returns and qualifications of its own members.” That leaves the final say up to the discretion of the U.S. Senate in Washington. There have been five cases in which the Senate has refused to recognize an appointee (although all but one occurred before the 17th Amendment and the direct election of senators). In 1912, the Senate concluded that a 33-year-old businessman named William Lorimer had obtained his seat (three years earlier) through bribery and corruption. The would-be lawmaker hailed from the great state of Illinois.

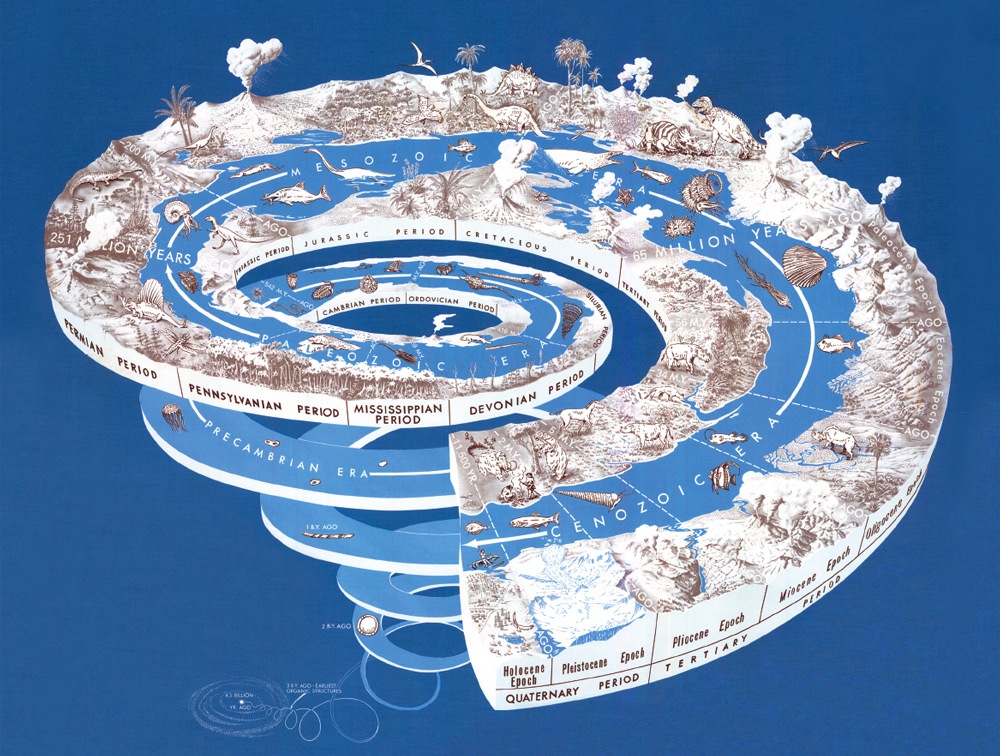

Age of the Earth

Here’s a nifty graphic from the USGS. This version is a little small; click it to see a bigger one at the USGS site, where you can also download even bigger copies.

The Earth is very old — 4.5 billion years or more according to recent estimates. Most of the evidence for an ancient Earth is contained in the rocks that form the Earth’s crust. The rock layers themselves — like pages in a long and complicated history — record the surface-shaping events of the past, and buried within them are traces of life — the plants and animals that evolved from organic structures that existed perhaps 3 billion years ago.

Also contained in rocks once molten are radioactive elements whose isotopes provide Earth with an atomic clock. Within these rocks, “parent” isotopes decay at a predictable rate to form “daughter” isotopes. By determining the relative amounts of parent and daughter isotopes, the age of these rocks can be calculated.

Thus, the results of studies of rock layers (stratigraphy), and of fossils (paleontology), coupled with the ages of certain rocks as measured by atomic clocks (geochronology), attest to a very old Earth!

John Maynard Keynes: An open letter to President Roosevelt

The following is an abridged text of an open letter [PDF] by John Maynard Keynes to the US president.

Dear Mr President,

You have made yourself the trustee for those in every country who seek to mend the evils of our condition by reasoned experiment within the framework of the existing social system. If you fail, rational change will be gravely prejudiced throughout the world, leaving orthodoxy and revolution to fight it out. But if you succeed, new and bolder methods will be tried everywhere, and we may date the first chapter of a new economic era from your accession to office. This is a sufficient reason why I should venture to lay my reflections before you, though under the disadvantages of distance and partial knowledge.

At the moment your sympathisers in England are nervous and sometimes despondent. We wonder whether the order of different urgencies is rightly understood, whether there is a confusion of aim, and whether some of the advice you get is not crack-brained and queer. If we are disconcerted when we defend you, this may be partly due to the influence of our environment in London. For almost everyone here has a wildly distorted view of what is happening in the United States. The average City man believes that you are engaged on a hare-brained expedition in face of competent advice, that the best hope lies in your ridding yourself of your present advisers to return to the old ways, and that otherwise the United States is heading for some ghastly breakdown. That is what they say they smell. There is a recrudescence of wise head-waging by those who believe that the nose is a nobler organ than the brain. London is convinced that we only have to sit back and wait, in order to see what we shall see. May I crave your attention, whilst I put my own view?

Continue reading “John Maynard Keynes: An open letter to President Roosevelt”

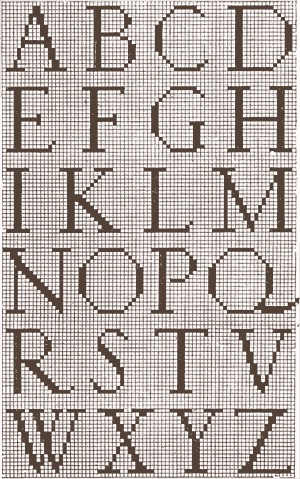

16C Pixel Garamond

We have here, courtesy of Jonathan Hoefler, a sample of a pixel font from 1567.

The struggle to adequately render letterforms on a pixel grid is a familiar one, and an ancient one as well: this bitmap alphabet is from La Vera Perfettione del Disegno di varie sorte di ricami, an embroidery guide by Giovanni Ostaus published in 1567.

If I’m counting correctly, the letters are 17 pixels high, and up to 17 wide. Of course, in context, it’s not all that surprising; it makes sense to use a pixellated font for embroidery. The resemblance of the font to Garamond (to my unschooled eye, anyway) is also not all that surprising: Claude Garamond died in 1561.

via John Gruber

LIFE photo archive hosted by Google

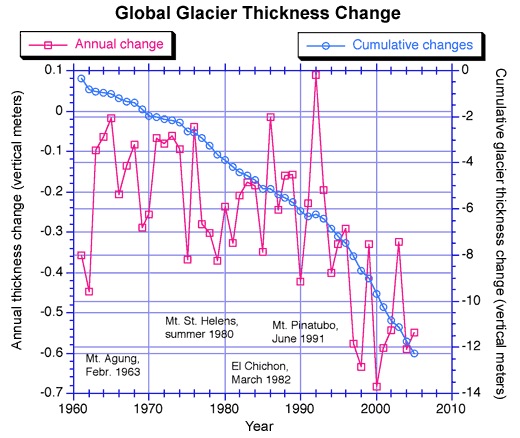

Global warming in pictures

Well, in charts, anyway. Barry Ritholtz collects some very nice examples, of which this is only one. Have a look.

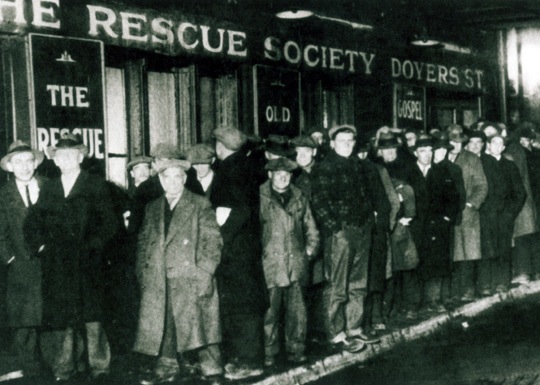

Brother, can you spare a dime?

Rob Kapilow talks about the Harburg/Gorney 1932 classic on NPR. It sounds alarmingly up to date, adjusted for inflation.

The article has links to several renditions of the song, of which Harburg’s is my favorite (though Daniel Schorr’s version, at the end of the audio version, is quite fine). YouTube has a perfectly awful version by George Michael, and a rather interesting performance by Mandy Patinkin on the David Letterman set. The audience isn’t sure whether it’s not an extended joke, but Patinkin sells it pretty well.

Susan Stamberg has a blog post on the piece, where Roger Hurwitz adds in comments:

The interview, which Susan references, was with the late Studs Terkel and appears in his recently published P.S. (New Press, 2008). In it Harburg said about the song “it was trying to expound a social theory… that our whole system of capitalism and free enterprise is based a rather illogical and unscientific groundwork: that we each exploit each other, we each get as much out of the wealth of the world that our ruthlessness… gives us permission to enjoy. and most people who don’t have that kind of power are left penniless, even though they do most of the producing.”

Harburg went on to say that if Cole Porter had written the song, the singer would be the man asked for the dime and would have given a half-dollar.

Patricia Spaeth, commenting on the main article, rightly complains that Kapilow ignores the verse; let’s have the whole thing, shall we?

Brother, Can You Spare a Dime

lyrics by Yip Harburg, music by Jay Gorney (1931)They used to tell me I was building a dream, and so I followed the mob,

When there was earth to plow, or guns to bear, I was always there right on the job.

They used to tell me I was building a dream, with peace and glory ahead,

Why should I be standing in line, just waiting for bread?Once I built a railroad, I made it run, made it race against time.

Once I built a railroad; now it’s done. Brother, can you spare a dime?

Once I built a tower, up to the sun, brick, and rivet, and lime;

Once I built a tower, now it’s done. Brother, can you spare a dime?Once in khaki suits, gee we looked swell,

Full of that Yankee Doodly Dum,

Half a million boots went slogging through Hell,

And I was the kid with the drum!Say, don’t you remember, they called me Al; it was Al all the time.

Why don’t you remember, I’m your pal? Buddy, can you spare a dime?Once in khaki suits, gee we looked swell,

Full of that Yankee Doodly Dum,

Half a million boots went slogging through Hell,

And I was the kid with the drum!Say, don’t you remember, they called me Al; it was Al all the time.

Say, don’t you remember, I’m your pal? Buddy, can you spare a dime?

Not policies that we can believe in

Dean Baker, posting at TPMCafe.

The High Priests of the Bubble Economy

Those following the meeting of Barack Obama’s economic advisory committee could not have been very reassured by the presence of Robert Rubin and Larry Summers, both former Treasury secretaries in the Clinton administration. Along with former Federal Reserve Board chairman Alan Greenspan, Rubin and Summers compose the high priesthood of the bubble economy. Their policy of one-sided financial deregulation is responsible for the current economic catastrophe.

It is important to separate Clinton-era mythology from the real economic record. In the mythology, Clinton’s decision to raise taxes and cut spending led to an investment boom. This boom led to a surge in productivity growth. Soaring productivity growth led to the low unemployment of the late 1990s and wage gains for workers at all points along the wage distribution.

…

Rather than handing George Bush a booming economy, Clinton handed over an economy that was propelled by an unsustainable stock bubble and distorted by a hugely over-valued dollar.

…

While the Bush administration must take responsibility for the current crisis (they have been in power the last eight years), the stage was set during the Clinton years. The Clinton team set the economy on the path of one-sided financial deregulation and bubble driven growth that brought us where we are today. (The deregulation was one-sided, because they did not take away the “too big to fail” security blanket of the Wall Street big boys.)For this reason, it was very discouraging to see top Clinton administration officials standing centre stage at Obama’s meeting on the economy. This is not change, and certainly not policies that we can believe in.

That old Lie

DULCE ET DECORUM EST

Bent double, like old beggars under sacks,

Knock-kneed, coughing like hags, we cursed through sludge,

Till on the haunting flares we turned our backs

And towards our distant rest began to trudge.

Men marched asleep. Many had lost their boots

But limped on, blood-shod. All went lame; all blind;

Drunk with fatigue; deaf even to the hoots

Of tired, outstripped Five-Nines that dropped behind.

Gas! Gas! Quick, boys! — An ecstasy of fumbling,

Fitting the clumsy helmets just in time;

But someone still was yelling out and stumbling,

And flound’ring like a man in fire or lime…

Dim, through the misty panes and thick green light,

As under a green sea, I saw him drowning.

In all my dreams, before my helpless sight,

He plunges at me, guttering, choking, drowning.

If in some smothering dreams you too could pace

Behind the wagon that we flung him in,

And watch the white eyes writhing in his face,

His hanging face, like a devil’s sick of sin;

If you could hear, at every jolt, the blood

Come gargling from the froth-corrupted lungs,

Obscene as cancer, bitter as the cud

Of vile, incurable sores on innocent tongues,

My friend, you would not tell with such high zest

To children ardent for some desperate glory,

The old Lie; Dulce et Decorum est

Pro patria mori.

Wilfred Owen, 1917

FDR, the Great Depression, and Obama

Paul Krugman, on economic lessons to be learned from the Great Depression.

Suddenly, everything old is New Deal again. Reagan is out; F.D.R. is in. Still, how much guidance does the Roosevelt era really offer for today’s world?

The answer is, a lot. But Barack Obama should learn from F.D.R.’s failures as well as from his achievements: the truth is that the New Deal wasn’t as successful in the short run as it was in the long run. And the reason for F.D.R.’s limited short-run success, which almost undid his whole program, was the fact that his economic policies were too cautious.

…

Now, there’s a whole intellectual industry, mainly operating out of right-wing think tanks, devoted to propagating the idea that F.D.R. actually made the Depression worse. So it’s important to know that most of what you hear along those lines is based on deliberate misrepresentation of the facts. The New Deal brought real relief to most Americans.That said, F.D.R. did not, in fact, manage to engineer a full economic recovery during his first two terms. This failure is often cited as evidence against Keynesian economics, which says that increased public spending can get a stalled economy moving. But the definitive study of fiscal policy in the ’30s, by the M.I.T. economist E. Cary Brown, reached a very different conclusion: fiscal stimulus was unsuccessful “not because it does not work, but because it was not tried.”

…

What saved the economy, and the New Deal, was the enormous public works project known as World War II, which finally provided a fiscal stimulus adequate to the economy’s needs.

…

The economic lesson is the importance of doing enough. F.D.R. thought he was being prudent by reining in his spending plans; in reality, he was taking big risks with the economy and with his legacy. My advice to the Obama people is to figure out how much help they think the economy needs, then add 50 percent. It’s much better, in a depressed economy, to err on the side of too much stimulus than on the side of too little.