Congress approved landmark legislation today that opens the door for a new era on Wall Street in which commercial banks, securities houses and insurers will find it easier and cheaper to enter one another’s businesses.

The measure, considered by many the most important banking legislation in 66 years, was approved in the Senate by a vote of 90 to 8 and in the House tonight by 362 to 57. The bill will now be sent to the president, who is expected to sign it, aides said. It would become one of the most significant achievements this year by the White House and the Republicans leading the 106th Congress.

“Today Congress voted to update the rules that have governed financial services since the Great Depression and replace them with a system for the 21st century,” Treasury Secretary Lawrence H. Summers said. “This historic legislation will better enable American companies to compete in the new economy.”

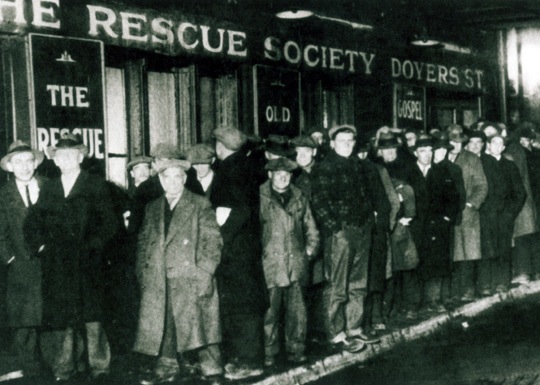

The decision to repeal the Glass-Steagall Act of 1933 provoked dire warnings from a handful of dissenters that the deregulation of Wall Street would someday wreak havoc on the nation’s financial system. The original idea behind Glass-Steagall was that separation between bankers and brokers would reduce the potential conflicts of interest that were thought to have contributed to the speculative stock frenzy before the Depression…

Administration officials and many Republicans and Democrats said the measure would save consumers billions of dollars and was necessary to keep up with trends in both domestic and international banking. Some institutions, like Citigroup, already have banking, insurance and securities arms but could have been forced to divest their insurance underwriting under existing law. Many foreign banks already enjoy the ability to enter the securities and insurance industries…

Consumer groups and civil rights advocates criticized the legislation for being a sop to the nation’s biggest financial institutions. They say that it fails to protect the privacy interests of consumers and community lending standards for the disadvantaged and that it will create more problems than it solves.

The opponents of the measure gloomily predicted that by unshackling banks and enabling them to move more freely into new kinds of financial activities, the new law could lead to an economic crisis down the road when the marketplace is no longer growing briskly.

“I think we will look back in 10 years’ time and say we should not have done this but we did because we forgot the lessons of the past, and that that which is true in the 1930’s is true in 2010,” said Senator Byron L. Dorgan, Democrat of North Dakota. “I wasn’t around during the 1930’s or the debate over Glass-Steagall. But I was here in the early 1980’s when it was decided to allow the expansion of savings and loans. We have now decided in the name of modernization to forget the lessons of the past, of safety and of soundness.”

Senator Paul Wellstone, Democrat of Minnesota, said that Congress had “seemed determined to unlearn the lessons from our past mistakes.”

“Scores of banks failed in the Great Depression as a result of unsound banking practices, and their failure only deepened the crisis,” Mr. Wellstone said. “Glass-Steagall was intended to protect our financial system by insulating commercial banking from other forms of risk. It was one of several stabilizers designed to keep a similar tragedy from recurring. Now Congress is about to repeal that economic stabilizer without putting any comparable safeguard in its place.”

Others said the legislation was essential for the future leadership of the American banking system.

“If we don’t pass this bill, we could find London or Frankfurt or years down the road Shanghai becoming the financial capital of the world,” said Senator Charles E. Schumer, Democrat of New York. “There are many reasons for this bill, but first and foremost is to ensure that U.S. financial firms remain competitive.”…

One Republican Senator, Richard C. Shelby of Alabama, voted against the legislation. He was joined by seven Democrats: Barbara Boxer of California, Richard H. Bryan of Nevada, Russell D. Feingold of Wisconsin, Tom Harkin of Iowa, Barbara A. Mikulski of Maryland, Mr. Dorgan and Mr. Wellstone.

In the House, 155 Democrats and 207 Republicans voted for the measure, while 51 Democrats, 5 Republicans and 1 independent opposed it. Fifteen members did not vote…

New software has enabled researchers to recreate a long forgotten musical instrument called the Lituus.

New software has enabled researchers to recreate a long forgotten musical instrument called the Lituus.