Two of Business Week’s worst predictions of 2008.

9. “In today’s regulatory environment, it’s virtually impossible to violate rules.” —Bernard Madoff, money manager, Oct. 20, 2007

10. A Bound Man: Why We Are Excited About Obama and Why He Can’t Win, the title of a book by conservative commentator Shelby Steele, published on Dec. 4, 2007.

Here’s one from Foreign Policy.

“[A]nyone who says we’re in a recession, or heading into one—especially the worst one since the Great Depression—is making up his own private definition of ‘recession.’” —Donald Luskin, The Washington Post, Sept. 14, 2008

Barry Ritholtz has a collection of ’em.

Late update! Bonus prediction of the actual future! With maps!

Mr. Panarin posits, in brief, that mass immigration, economic decline, and moral degradation will trigger a civil war next fall and the collapse of the dollar. Around the end of June 2010, or early July, he says, the U.S. will break into six pieces — with Alaska reverting to Russian control.

via Felix Salmon

Joe the Plumber is headed to Israel, to “cover the Gaza conflict from the Israelis’ point of view”. Is he worried about the danger? Not a bit of it.

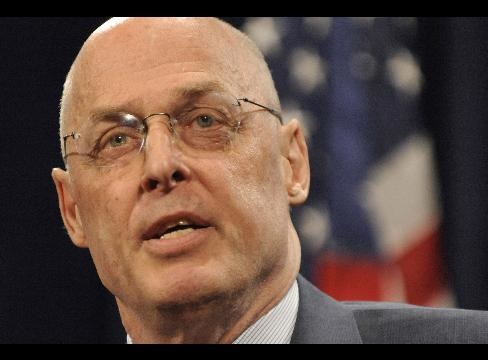

Joe the Plumber is headed to Israel, to “cover the Gaza conflict from the Israelis’ point of view”. Is he worried about the danger? Not a bit of it. Henry Paulson may be the most powerful manager of money in the world and he still couldn’t do for taxpayers with the $700 billion bailout of American banks what Warren Buffett did for his shareholders in investing in Goldman Sachs Group Inc.

Henry Paulson may be the most powerful manager of money in the world and he still couldn’t do for taxpayers with the $700 billion bailout of American banks what Warren Buffett did for his shareholders in investing in Goldman Sachs Group Inc.