The price of oil that is; thus Dave Cohen. I won’t try to summarize; the argument isn’t hard to follow, though.

Today’s NYMEX WTI oil price, about $45/barrel, is dangerously, outrageously low. Crude oil is not some “inconsequential penny stock” as Clive Maund pointed out, but that’s how it’s been priced (321Energy, November 19, 2008). I am going to talk about how oil prices get set in a futile attempt to understand what future prices might look like. I find little reason for optimism regarding the market’s ability to provide a coherent oil price signal reflecting future scarcity of this precious non-renewable resource.

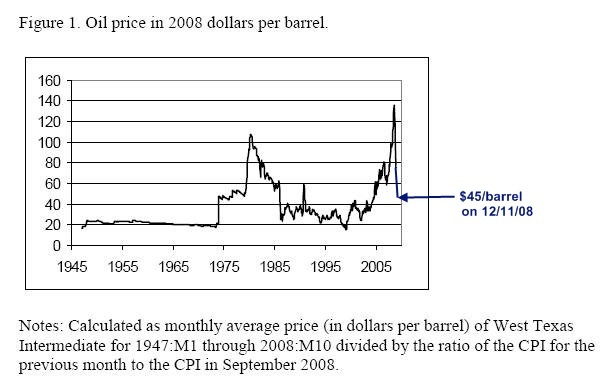

Figure 1 is taken from James Hamilton’s Understanding Crude Oil Prices (UCSD Department of Economics, November 7, 2008); updated (in blue) to reflect the current price.

… The issue discussed in this essay is whether the price does or does not tell us about Our Oil Future. It does not. We know the $45 oil price is not right as we look down the road to a time when the global economy rises like a Phoenix from the ashes. Because of the nature of oil pricing, I find it likely that we revisit the 2008 nightmare over and over again in future years.

via James Hamilton