America’s Socialism for the Rich: Corporate Welfarism

By Joseph Stiglitz

With all the talk of “green shoots” of economic recovery, America’s banks are pushing back on efforts to regulate them. While politicians talk about their commitment to regulatory reform to prevent a recurrence of the crisis, this is one area where the devil really is in the details — and the banks will muster what muscle they have left to ensure that they have ample room to continue as they have in the past.

The old system worked well for the banks (if not for their shareholders), so why should they embrace change? Indeed, the efforts to rescue them devoted so little thought to the kind of post-crisis financial system we want that we will end up with a banking system that is less competitive, with the large banks that were too big too fail even larger.

… The Obama administration has, however, introduced a new concept: “too big to be financially restructured”. The administration argues that all hell would break loose if we tried to play by the usual rules with these big banks. Markets would panic. So, not only can’t we touch the bondholders, we can’t even touch the shareholders — even if most of the shares’ existing value merely reflects a bet on a government bailout.

I think this judgment is wrong. I think the Obama administration has succumbed to political pressure and scare-mongering by the big banks. As a result, the administration has confused bailing out the bankers and their shareholders with bailing out the banks.

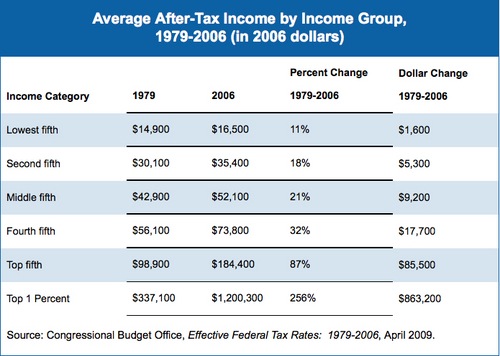

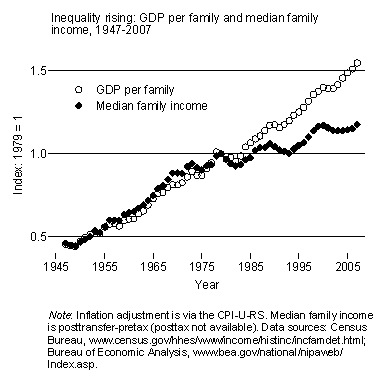

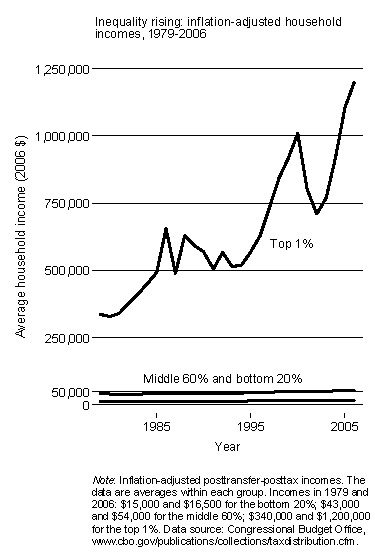

… Some have called this new economic regime “socialism with American characteristics.” But socialism is concerned about ordinary individuals. By contrast, the United States has provided little help for the millions of Americans who are losing their homes. Workers who lose their jobs receive only 39 weeks of limited unemployment benefits, and are then left on their own. And, when they lose their jobs, most lose their health insurance, too.

America has expanded its corporate safety net in unprecedented ways, from commercial banks to investment banks, then to insurance, and now to automobiles, with no end in sight. In truth, this is not socialism, but an extension of long standing corporate welfarism. The rich and powerful turn to the government to help them whenever they can, while needy individuals get little social protection.

We need to break up the too-big-to-fail banks; there is no evidence that these behemoths deliver societal benefits that are commensurate with the costs they have imposed on others. And, if we don’t break them up, then we have to severely limit what they do. They can’t be allowed to do what they did in the past — gamble at others’ expenses.

This raises another problem with America’s too-big-to-fail, too-big-to-be-restructured banks: they are too politically powerful. Their lobbying efforts worked well, first to deregulate, and then to have taxpayers pay for the cleanup. Their hope is that it will work once again to keep them free to do as they please, regardless of the risks for taxpayers and the economy. We cannot afford to let that happen.

It must be depressing to be Paul Krugman. No matter how well the economy performs, Krugman’s bitter vendetta against the Bush administration requires him to hunt for the black lining in a sky full of silvery clouds. With the economy now booming, what can Krugman possibly have to complain about? In today’s column, titled

It must be depressing to be Paul Krugman. No matter how well the economy performs, Krugman’s bitter vendetta against the Bush administration requires him to hunt for the black lining in a sky full of silvery clouds. With the economy now booming, what can Krugman possibly have to complain about? In today’s column, titled