Stuart Staniford of The Oil Drum discusses the Petroleum Review’s rather optimistic projections of future oil production based on new megaprojects coming on line over the next few years.

The executive summary is that while I think this report

- was a good deal of work and is a considerable service to the public

- has some improvements from prior “bottom-up” reports

nonetheless, to no-one’s surprise perhaps,

- I don’t think this methodology is reliable at this time.

- I disagree with the conclusions of the report.

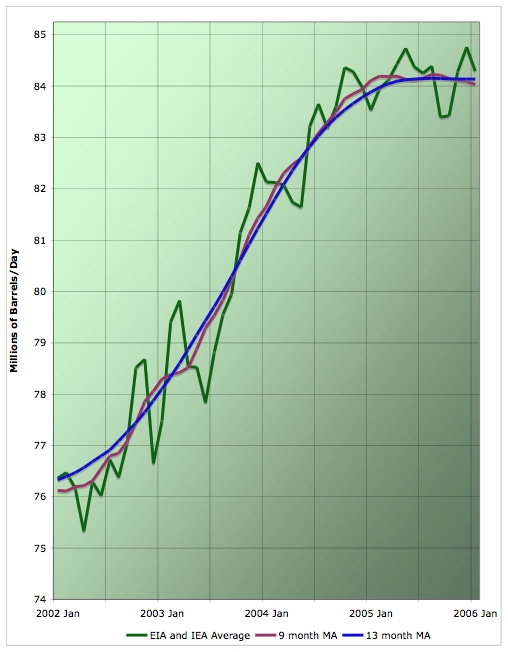

Staniford presents a graph of daily oil production:

Average daily oil production, by month, EIA and IEA (corrected) estimate averaged. Also a nine month centered moving average of the monthly series. Click to enlarge. Believed to be all liquids. Graph is not zero-scaled. Source: IEA, and EIA.

My basic view is that we are in a bumpy plateau until we hit a big oil shock because one of the various simmering problems around the global oil supply system boils over and sharply cuts supply for a while. Or in the alternative, we are in a bumpy plateau until the housing-bubble/crazy-hedge-fund-credit-derivative/global-trade-imbalance situation blows up and cuts demand for a while (eg see Mish for a primer). My wild-ass-guess probability of one of those things happening is about 0.2-0.4 per year. Which means we won’t have to wait too many years.

All this via James Hamilton’s piece at Econobrowser on the consequences for oil prices.

Stuart Staniford … argues that the free-market economies such as the U.S., Canada, and Europe, in which consumers have not been protected from the price increases, are the places we have seen reductions in the quantity of oil consumed so far, whereas the growth in demand is strongest where the price remains subsidized.

That is a very interesting observation, and I agree that the oil producing countries with their growing incomes may make an important contribution to global petroleum demand in the years to come. But I would hesitate to dismiss the role of the incentive to conserve even in those consuming countries where the governments currently appear inclined to pretend none of this is really happening. Even if consumers don’t have an incentive to respond, the governments themselves, however unenlightened as they may be, are surely going to notice the effect of trying to maintain a subsidy on their own budgets, and eventually will find themselves without the resources to keep their fingers in the dike.

In sum, oil prices are volatile, oil production is hard to predict, and regardless of what happens, someone is going to be able to say, “I told you so.”

There are three things that concern me about oil. 1) No truly large reservoirs have been found in decades, though a number of medium-sized reservoirs have been found. The rest are smaller finds.

2) The number of wells being drilled around the world is beginning to look like an exponential curve that’s sharply climbing in order to keep up with demand.

3) We’re having to go to more and more remote and difficult to access places to get oil; not only is this the canary in the mine about longterm supplies, but people need to realize that it’s getting more expensive to produce oil.

Yep, there’s going to be considerable volatility for a while. And politics.

Hello my loved one! I wish to say that this article is awesome, nice written and include almost all

vital infos. I would like to peer more posts like this .