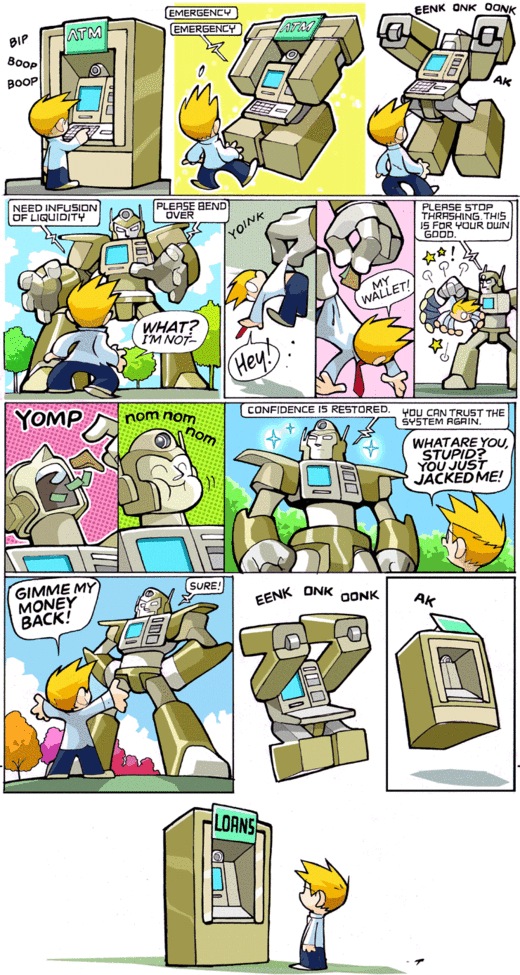

Sinfest, via Barry Ritholtz

See also cactus at Angry Bear:

Some thoughts on the bail-out:

1. Goldman’s market cap is about 50 billion. The gubmint is gonna buy $10 billion worth of (non-dilutive, non-voting) shares, for which it gets essentially, well, nothing. Nothing at all. Goldman will go about its business. So… Goldman is getting an infusion equal to 20% of its worth, plus a guarantee that the gubmint will replace whatever excrement it purchased with something of value. And somewhere along the line, you can bet that the gubmint will also end up doing the same favor to everyone who bought excrement Goldman sold. Even a company that sold wedgies would make a mint with that sort of gubmint help.

2. The bail-out will succeed only, repeat, only in the sense that the US succeeded in Iraq in 2003 and 2004 when Simone Ledeen and the rest of the Heritage interns were running around the country handing out trash bags full of money and giving Halliburton money for services it would never begin to render. There will be less yabbering of silly catchphrases like “but what about all the schools that were painted?” this time around, though, because the schools will be exploding when GW is no longer in office. To be extremely precise, this is what I think the success will look like: shady, undeserving characters will be enriched, young versions of the idiots who got us into the mess will launch successful careers (can you say “Kashkari”?), and the promised benefits to the American public, the schmucks footing the bill, will never materialize.

3. The reason the bail-out won’t succeed, like Iraq, is that it doesn’t address a real problem. Banks going under is not a problem. Bankers having incentives to make risky decisions is a problem, and this bail-out will do nothing to stop it. (Non-voting shares, remember?) My guess is that we’ll find some entities (and I would bet money Goldman Sachs will be on that list) will be found to be gaming the system. There will be a tsk-tsk when that comes to light, but they will not have to pay back the gubmint for gaming the system.

4. The bigger problem, that there was a housing bubble, and that home prices cannot and should not stay as high as they have been is not addressed by the bail-out. If it ever does get addressed, it will be addressed in a counter-productive way.

5. The even bigger problem, that the American public has been stretched thin financially for years now and can’t afford the sort of consumption that makes up about two thirds of the economy is also not going to be addressed by the bail-out.

I hope I’m wrong, because I don’t see this coming out well. I do have a proposal, a small one. I figure if the gubmint doesn’t get any say in how banks do business (exactly why is it so important to keep the “talent” that created this mess in the first place?) and foots the bill, can we at least require every bank that takes government money to include the words “Welfare Queen” in its name? I think it would be a very useful thing if Goldman Sachs were forced to call itself Welfare Queen Goldman Sachs. It might make a few members of the voting public realize exactly how the system work.

_____________________________

by cactus